Chapter four of the FTSE 350 DC Pension Survey 2021

This latest survey reveals that 61% of the FTSE 100 and 82% of the FTSE 250 now participate in either a master trust or a contract-based pension scheme. We expect these numbers to increase as the Pensions Regulator introduces its new governance requirements through the proposed singular modular code.

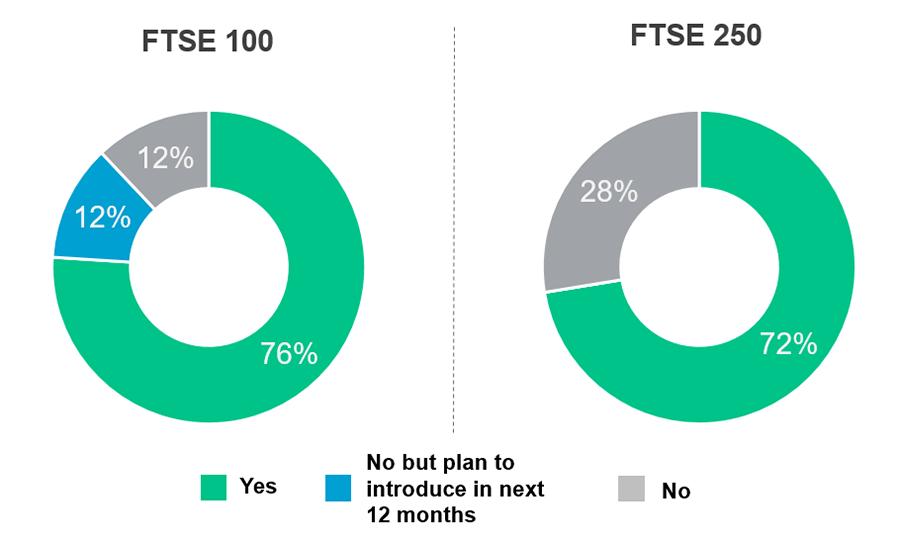

Given the growing number of employers and scheme sponsors moving towards master trusts, and with the already established market for contract-based schemes, it is reassuring to see that 88% of FTSE 100 and 72% of FTSE 250 companies using these vehicles are, or will soon be, operating defined contribution (DC) governance committees.

These committees typically aim to provide effective oversight from a strategic and corporate perspective. Although master trusts and contract-based plans operate with their own trustee boards or independent governance committees (IGCs), their oversight will inevitably be generic and will not always focus on specific issues that may be important to the sponsoring company and its employees.

Note: Sample excludes trust-based schemes and “Don’t know” was excluded.

Source: FTSE 350 DC Pension Scheme Survey, 2021

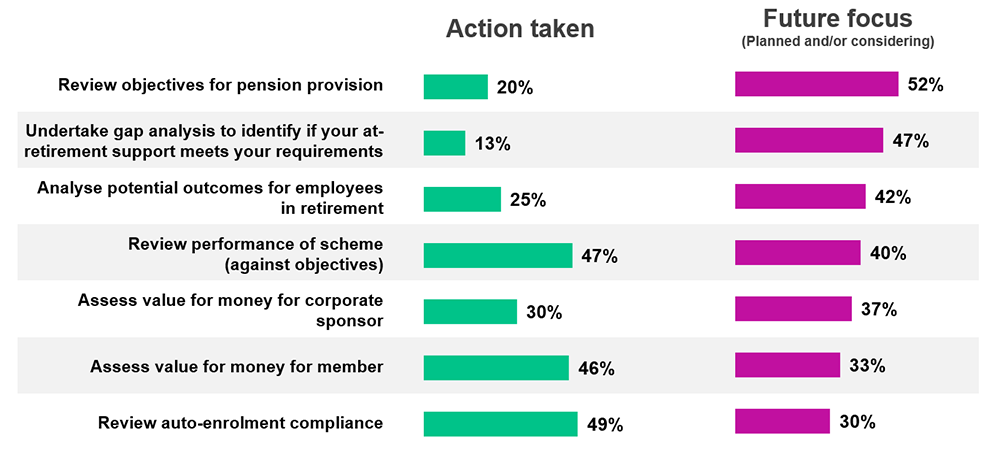

For many, the move to a master trust or contract-based scheme will be the first experience of outsourcing a core benefit for their employees. However, while aspects of the DC pension plan are left with the master trust trustees or contract-based provider, the survey results show that employers are reviewing the schemes against a set of objectives, ensuring that the company complies with its auto-enrolment obligations and delivers value for money for both sponsor and members.

Source: FTSE 350 DC Pension Scheme Survey, 2021

Looking at the future focus column in the chart, it is interesting to see that nearly half of those with master trusts and contract-based schemes plan to undertake a gap analysis to identify if at-retirement support meets employee requirements and over half of companies plan to review the objectives for their pension provision. That may be to ensure that the governance committee has appropriate focus and perhaps also to consider alternative savings options alongside pensions. This suggests a move to a more strategic approach and away from monitoring the day-to-day operational performance of providers.

“It is reassuring to see that 88% of FTSE 100 and 72% of FTSE 250 companies using these vehicles are, or will soon be, operating DC governance committees.”

James Colegrave | Senior Director, Retirement

We believe that governance committees for master trust and contract-based schemes are not about attempting to replicate a traditional trustee model. Rather, they are concerned with adequate and proportionate oversight of the ongoing contribution spend and agreeing a set of objectives against which the DC arrangement can be monitored.

With this employer oversight, members of a DC pension scheme can benefit from:

Despite the move away from trust-based arrangements, governance is here to stay. That’s reassuring given the growing legislation in the US against employers who have failed to adequately oversee their pension arrangements, leading to some poorly designed and expensive pension plans. It seems that most UK companies have recognised that risk and have identified the need to take appropriate action.

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DC Pension Survey 2021 | 4.9 MB |