Chapter two of the FTSE 350 DC Pension Survey 2021

The results of the survey support other evidence that financial wellbeing is high on the agenda for many organisations. Furthermore, many respondents are using the defined contribution (DC) pension scheme as a catalyst for change or as a key component in the delivery of a financial wellbeing programme.

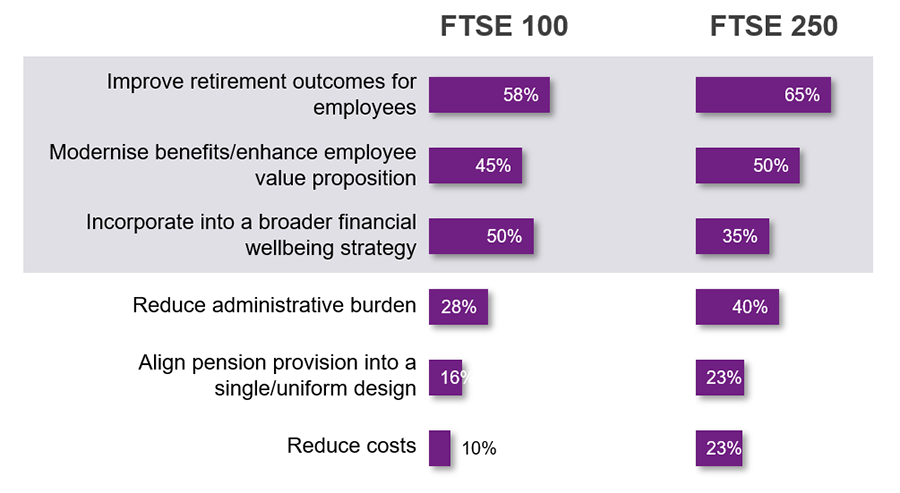

Across the FTSE 350, incorporating the DC pension scheme into a broader financial wellbeing strategy is a top-three priority for the organisation’s benefits provision. Linked to this is the aspiration of improving employee pension outcomes and modernising the wider employee-benefits programme, both of which are also a focus for organisations in the short term. Interestingly, for larger organisations in the FTSE 100, the aim of integrating pensions into a financial wellbeing programme is more important – 50% of FTSE 100 companies have this as a focus compared to 35% of FTSE 250 companies. Possibly this is because they have already taken action to improve the DC pension scheme and wider benefits.

Note: Percentages are “4/5 Major focus”.

Source: FTSE 350 DC Pension Scheme Survey, 2021

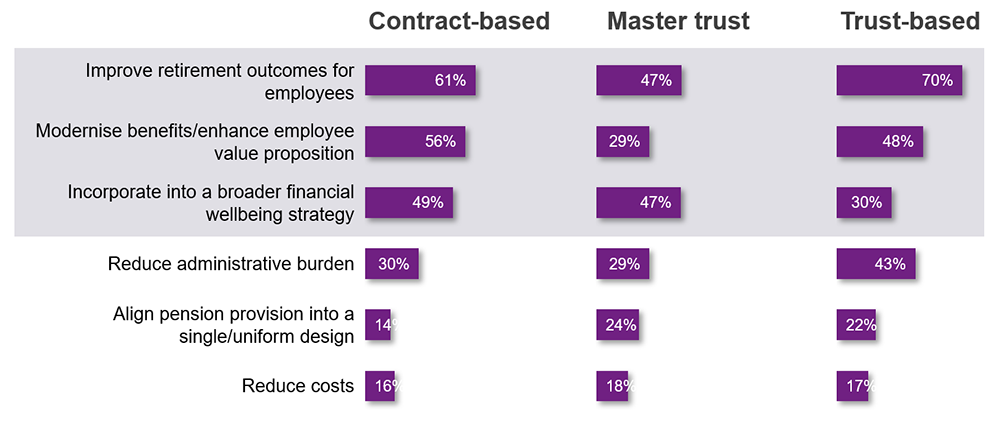

Organisations that have moved to a master trust appear much more likely to focus on improving employee financial wellbeing by incorporating pensions into wider benefit programmes than those with trust-based schemes. Of those surveyed, 47% of those with master trusts say this is their focus against 30% of those with trust-based schemes. This may be because those with master trust schemes feel that they have already switched to a more up-to-date and effective pension delivery vehicle in order to improve retirement outcomes and modernise benefits.

In contrast, those with trust-based schemes retain an emphasis on improving member outcomes –70% for trust-based versus 47% for master trusts. It is difficult to know with certainty why this is the case, but it may be that for these schemes it is the trustees who are controlling the agenda and looking at the whole membership, including deferred members. Whereas for those with a master trust or contract-based scheme, the employer places more emphasis on active employees.

Interestingly, those employers with contract-based schemes have an interest in enhancing all three areas, possibly because they feel the incumbent provider is failing to deliver adequate support.

Note: Percentages are “4/5 Major focus”.

Source: FTSE 350 DC Pension Scheme Survey, 2021

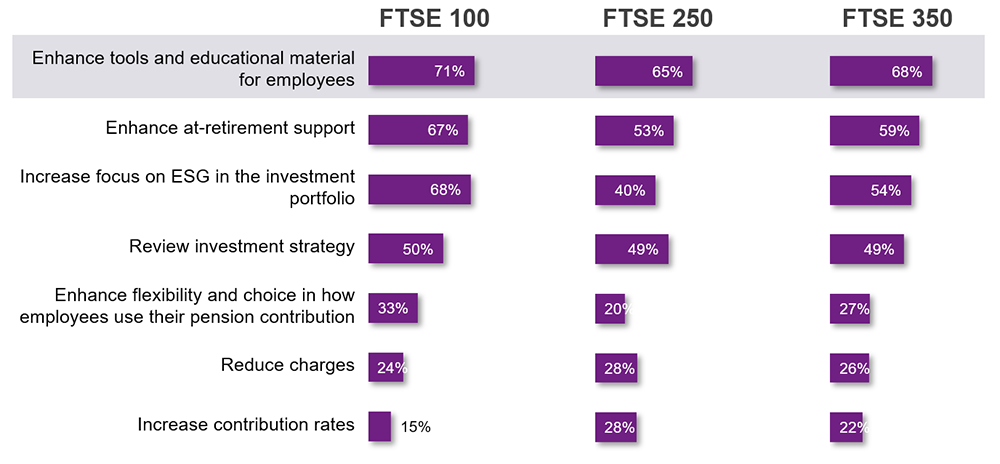

An integral part of supporting employees and pension scheme members with financial wellbeing is providing them with educational support and tools. The survey demonstrates that employers have recognised this and have a clear intention of enhancing these interventions – it is a leading priority in delivering value for members over the next two years. This response applies across all sizes of company and all types of schemes, with more than two-thirds of respondents saying that improving tools and educational materials is a focus.

This emphasis on employee education and support confirms the findings of the Willis Towers Watson Future of Financial Wellbeing Survey 2021, which also found that this was the number one priority for enhancing existing financial wellbeing programmes over the next two years.

Note: Percentages are “4/5 Major focus”.

Source: FTSE 350 DC Pension Scheme Survey, 2021

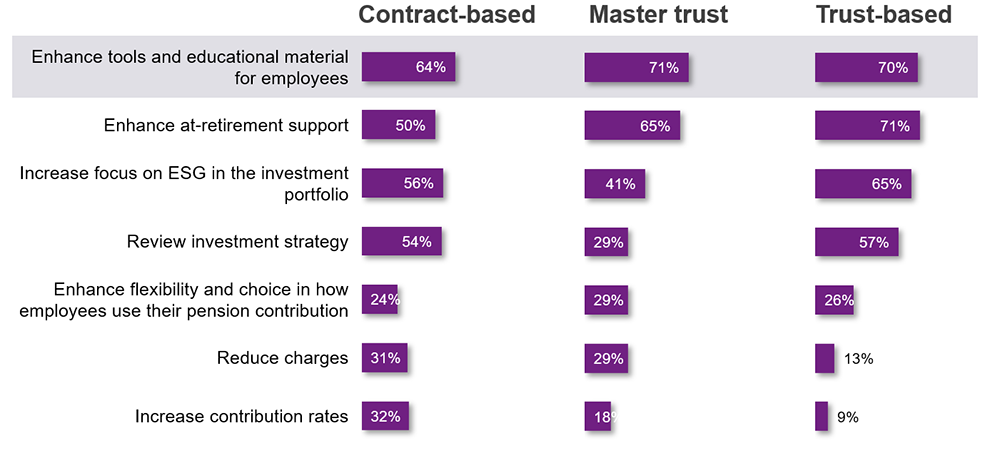

Note: Percentages are “4/5 Major focus”.

Source: FTSE 350 DC Pension Scheme Survey, 2021

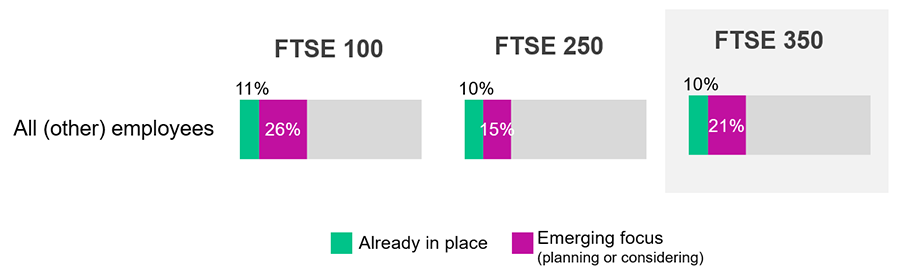

Finally, reviewing DC pension plan design is also on the agenda. While the importance of maintaining pension savings is reflected in the level of contributions paid, it is also recognised that some employees may have other financial priorities. The survey found that the number of employers offering a plan design allowing members to flex their pension contribution and possibly re-direct some funding to an alternative savings vehicle could triple over the next two years – from 10% of employers to 31%.

Identifying different employee needs in this way, and facilitating flexibility, is key to any successful financial wellbeing programme.

Source: FTSE 350 DC Pension Scheme Survey, 2021

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DC Pension Survey 2021 | 4.9 MB |