Modernising Benefits in Asia Pacific – Part 3

With escalating medical inflation, rising lifestyle health risks and chronic conditions, and an increasingly stressed workforce further leading to poor health habits, benefit cost management is – and continues to be – a growing challenge for Asia Pacific employers.

In this article, we will investigate what’s driving these rising costs, and how employers can design and deliver a sustainable benefit package — one that demonstrates their willingness to invest in the health and wellbeing of their employees without being cost prohibitive.

This article is the third in a six-part series on modernising benefits, in which we look at how employers can design and deliver their benefits for tomorrow’s workforce, using the holistic approach outlined in the Benefits Navigator.

An operating model to make, execute and monitor strategic decisions related to benefit programs.

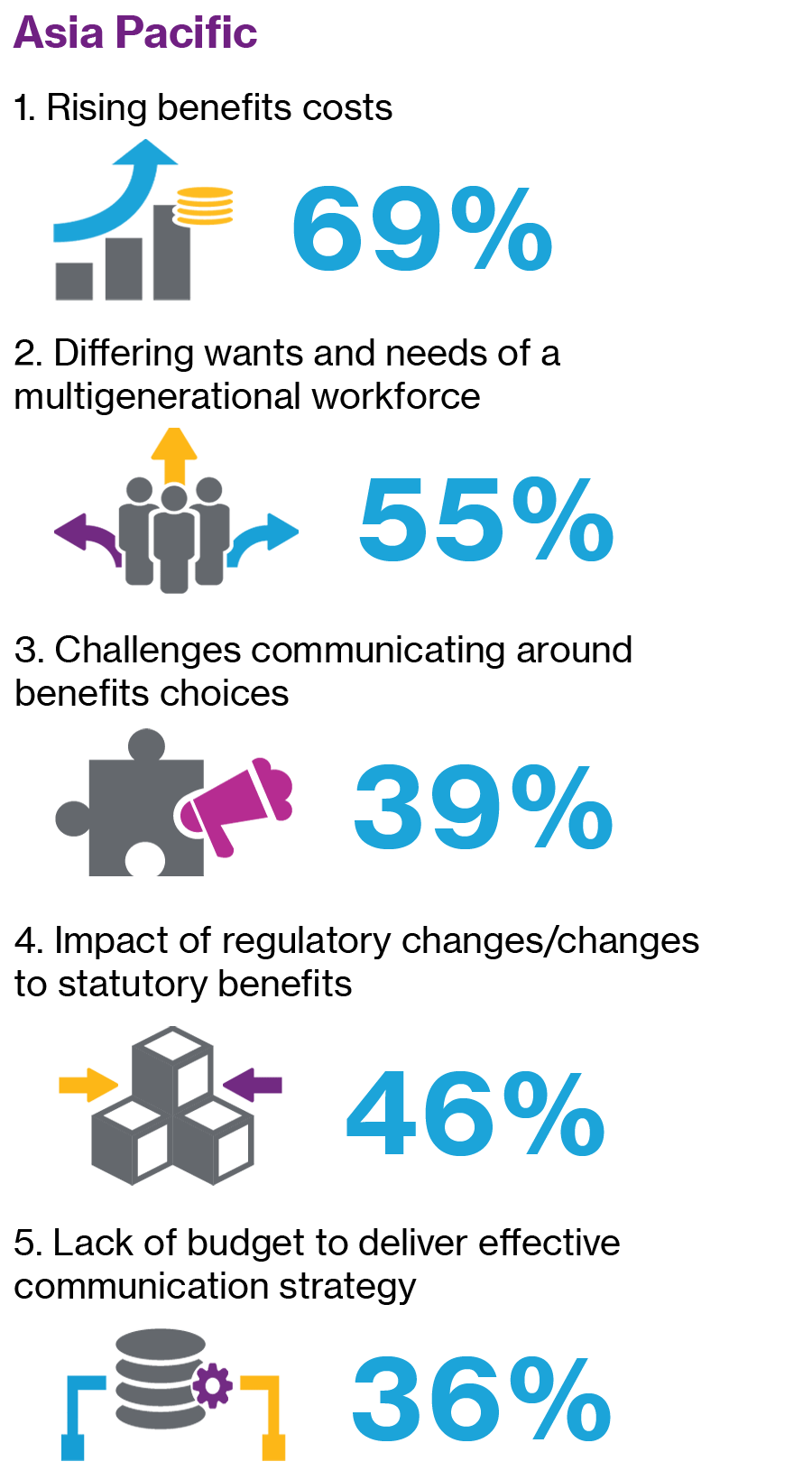

According to our 2019/2020 Benefit Trends Survey, almost seven in 10 employers in Asia Pacific reported that rising benefit costs were a primary challenge.1 In addition, escalating medical inflation poses a long-term challenge to sustainability of benefit offerings: For 2020, the region is expecting medical costs to increase by an average of 7.1%, far outstripping general inflation. Global insurers and their counterparts in the region see this trend continuing for the foreseeable future.2

Source: Willis Towers Watson 2019/2020 Benefit Trends Survey – Asia Pacific

When it comes to employee or provider behaviour, medical insurers report that the two leading causes of increased costs are an excess of services recommended (cited by an overwhelming majority of 86% insurers in Asia Pacific), and overuse of care by insured members (67%). Poor quality or misuse of care because of unintegrated primary, specialty and facility care ranked as third (35%).

However, many cost drivers also lie outside the control of employees and providers, and are due to more structural challenges. For instance, 71% of insurers noted that costs are driven by new medical technologies.

Cancer is the most expensive condition, with 86% of insurers citing it as their largest health care expense, with circulatory diseases and musculoskeletal conditions at 41% and 48%, respectively. These conditions can be associated with lifestyle factors, such as nutrient-deficit diets and poor sleeping habits. Asia Pacific employees put in some of the longest working hours in the world.3

The most significant emerging concern is mental health, with nearly three in 10 employees worldwide experiencing stress, depression or anxiety.4 Psychiatric conditions can potentially raise health care costs and impact lifestyles through changes in behaviour, as well as affect their workplace productivity, social connections and physical condition.

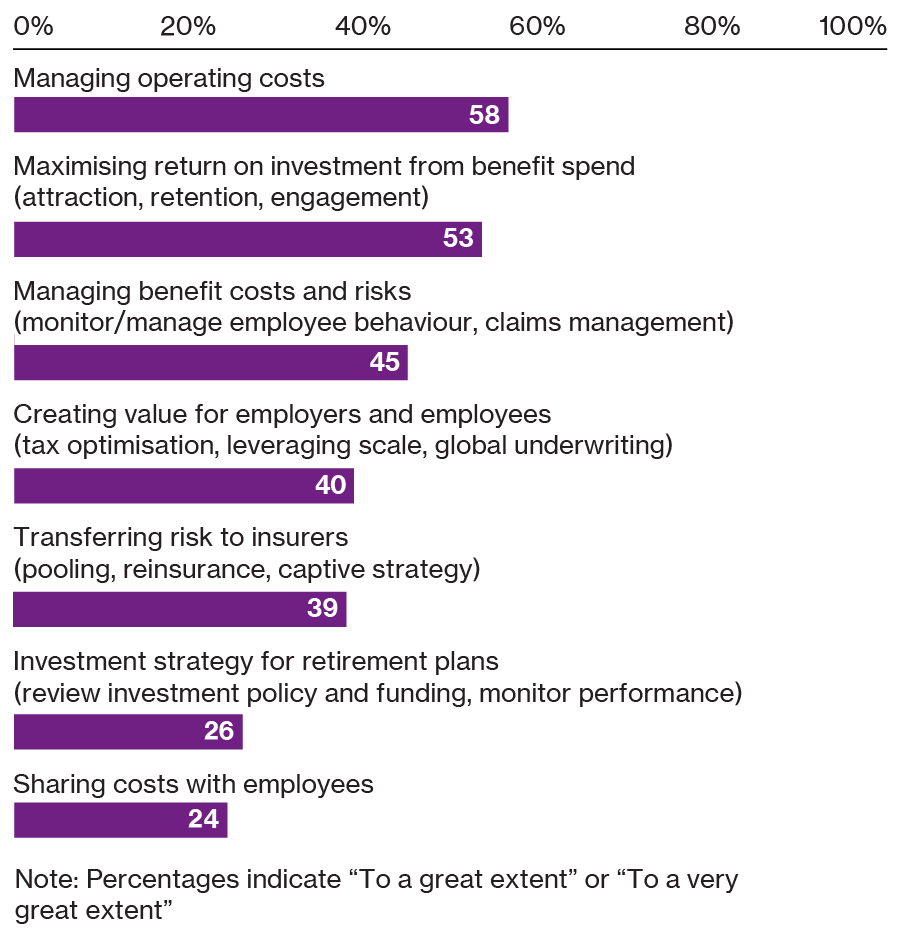

It’s no surprise that managing costs is a top priority. Our research shows, however, that when employers look to tackle costs, they do so mostly from a day-to-day, operational standpoint. In contrast, only 40% are looking at this as a proactive way of creating value for employees and employers through methods such as tax optimisation or leveraging scale.

An emerging financing option in Asia Pacific is a risk transfer to insurers, through a pooling or captive arrangement, which four in 10 employers said is a priority for financing their benefits.

The actions considered by organisations to be top priorities for the financing of benefit programs.

Source: 2019/2020 Benefit Trends Survey – Asia Pacific

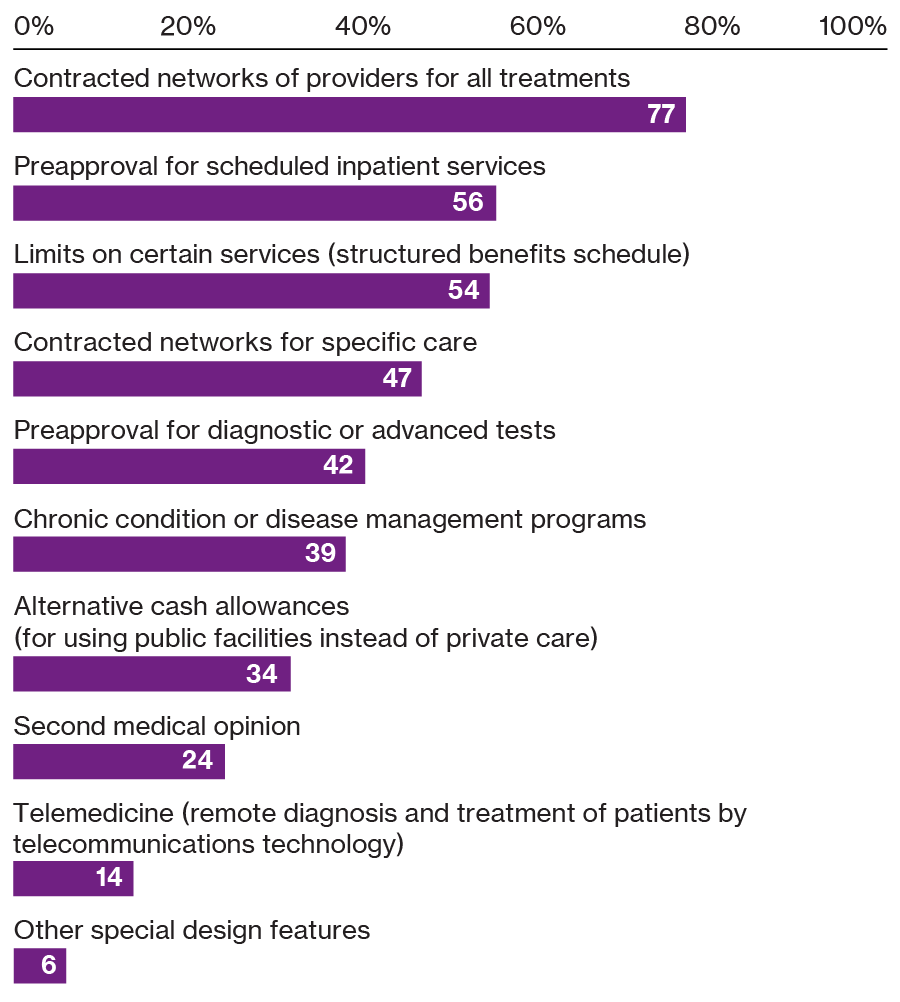

When it comes to the types of cost management methods used, a popular option in the region, cited by 77% of insurers, is to use universally contracted care providers, as they can negotiate lower premiums. More than half are also looking at limits on certain services to manage costs.

Four in 10 Asia Pacific insurers said they use programs for managing chronic conditions to keep costs low. Some of these programs focus on mitigating the lifestyle and behaviours that can worsen an existing condition. Others focus on providing an incentive for healthy employees to avoid behaviours that could lead to a chronic condition, with non-monetary incentives such as company-branded items or social reinforcement being more effective.5

More than a third of insurers in Asia Pacific look toward the use of cash allowances usable only for public facilities as a means of cost management. This means that employees can only use the allowances for care, treatment and procedures done in a government-owned facility.

In the near future, technology may become an effective means of managing medical costs.

In the near future, technology may become an effective means of managing costs. Remote diagnosis and advanced medical solutions are still in their infancy, but as the technology becomes more stable and readily available, these could positively contribute to more sustainable medical benefits. Today, only 14% of insurers in Asia Pacific use telemedicine and similar technologies as a cost management tool, compared to 49% globally.

The most effective tools employed for managing medical costs as reported by insurers.

Source: 2020 Global Medical Trends Survey

Member coinsurance (payment of a fixed percentage of services) is an increasingly popular method of cost-sharing for medical claims, with 56% of insurers in Asia Pacific considering it a ‘typical’ or ‘very typical’ offering. Member copays (payment of a flat fee) are relatively popular at 33%. Deductibles are also becoming a prominent choice in Asia Pacific. Across the region, 49% of organisations typically offer this option. These types of cost-sharing methods help reduce unnecessary procedures by encouraging more careful consideration of medical costs. An important side effect of cost-sharing is the expectation employees have for greater transparency of these transactions, such as more open communication on billing and costs.

Communication and transparency with employees around benefits can help to underline the value of their benefit package. Employees that understand their benefits are more likely to engage in these programs, align with their employers’ wellbeing goals and make effective use of their health care provisions, which in turn can help organisations to realise their investments and decrease costs over time. Transparency builds trust, a critical element of the employer-employee relationship.

Employers can adopt comprehensive and varied methods of communicating with their people. Traditional means, such as lifestyle-focused seminars led by HR, could be complemented with digitalised methods, such as online portals. In determining the approach, it’s important that employers use a design thinking mindset, to ensure that it is relevant, inclusive and meaningful to their unique workforce and corporate culture.

Employers facing challenges in benefit design and delivery will require fresh, innovative approaches, especially around financing and cost management. Among the multiple ways to mitigate and manage costs, options such as employee copays, pooling/captives, tax optimisation and prevention-based lifestyle programs are beginning to reap success by keeping cost escalation under control. Through creative problem-solving, employers can set up a portfolio that will be financially resilient through economic challenges in the ever-changing business landscape.

Equally important to sustaining benefit financing is helping employees become mindful of their value. Communication and transparency will be key to aligning the employee and employer perspectives. Look out for our next article in this series, focused on the talent experience when modernising your benefit strategy.

1 Willis Towers Watson 2019/2020 Benefit Trends Survey — Asia Pacific

2 Willis Towers Watson 2020 Global Medical Trends Survey Report

3 HRM Asia: ASEAN Employees Working the Longest Hours

4 Willis Towers Watson 2017/2018 Global Benefit Attitudes Survey

5 Incentive Research Foundation, The Benefits of Tangible Non-Monetary Incentives

To find out more about how to optimise the financing of your benefits program, please contact:

| Title | File Type | File Size |

|---|---|---|

| Modernising Benefits in Asia Pacific - Part 3 | 3.5 MB |