Modernising Benefits in Asia Pacific — Part 2

In this six-part article series, we discuss how employers in Asia Pacific can navigate the Future of Benefits. As discussed in Part 1, when modernising benefits, employers must work on many fronts at once, including how to design a modern portfolio of benefits; finance it efficiently; take into account how their talent experiences benefits; administer them effectively; and use analytics and insights to make smart decisions (see Benefits Navigator figure below).

By focusing on what matters most, the ideal portfolio will strike a balance for both the employee and employer.

In this article, we will take a closer look at how employers can design a portfolio of benefits that is modern, cost effective and relevant to their workforce while being flexible enough to weather the inevitable change that today's business landscape brings. By focusing on what matters most, the ideal portfolio will strike a balance for both the employee and employer.

Ensuring that the portfolio of benefits offered is in line with the organisational culture and objectives, and evolving values and preferences of employees.

Optimising the financing of benefits through purchasing scale leverage to reduce costs, efficient risk management and transfer, and cost sharing.

Creating a personalised talent experience when individuals select and use the benefits program, including how we support their decision making, deliver and administer the program.

Deploying technology and resources effectively for the administration and operations of the benefits program, including policies, procedures and regulatory and governance framework.

Using data-driven analytics, insights and reporting to make informed decisions around managing utilisation and cost of benefit programs.

Employers in Asia Pacific must adapt to an environment under constant disruption and change. A recent study by Willis Towers Watson on the Future of Work1 highlights some interesting facts about how automation and Artificial Intelligence are changing the work environment: Three out of every ten organisations are now redesigning jobs that require different sets of skills, and this percentage is expected to grow by nearly 20 percentage points three years into the future (Figure 1). Additionally, roughly half of employers (48%) believe that they will need fewer employees in the next three years because of automation.

This has created a shift in the work ecosystem that employers worldwide need to navigate with a new approach, one that emphasises new skills and the potential to source those skills in a number of different ways.

Figure 1. The impact of automation

Source: Willis Towers Watson 2017/2018 Global Future of Work Study – Asia Pacific

The idea of organisations competing for talent is not new. Companies have always wanted the best possible employees with the necessary skills and competencies to accelerate growth and outperform the competition. However, the shift towards digitalisation has served to put more pressure on HR to attract and retain employees with IT and digital skillsets in a very competitive but niche talent segment.

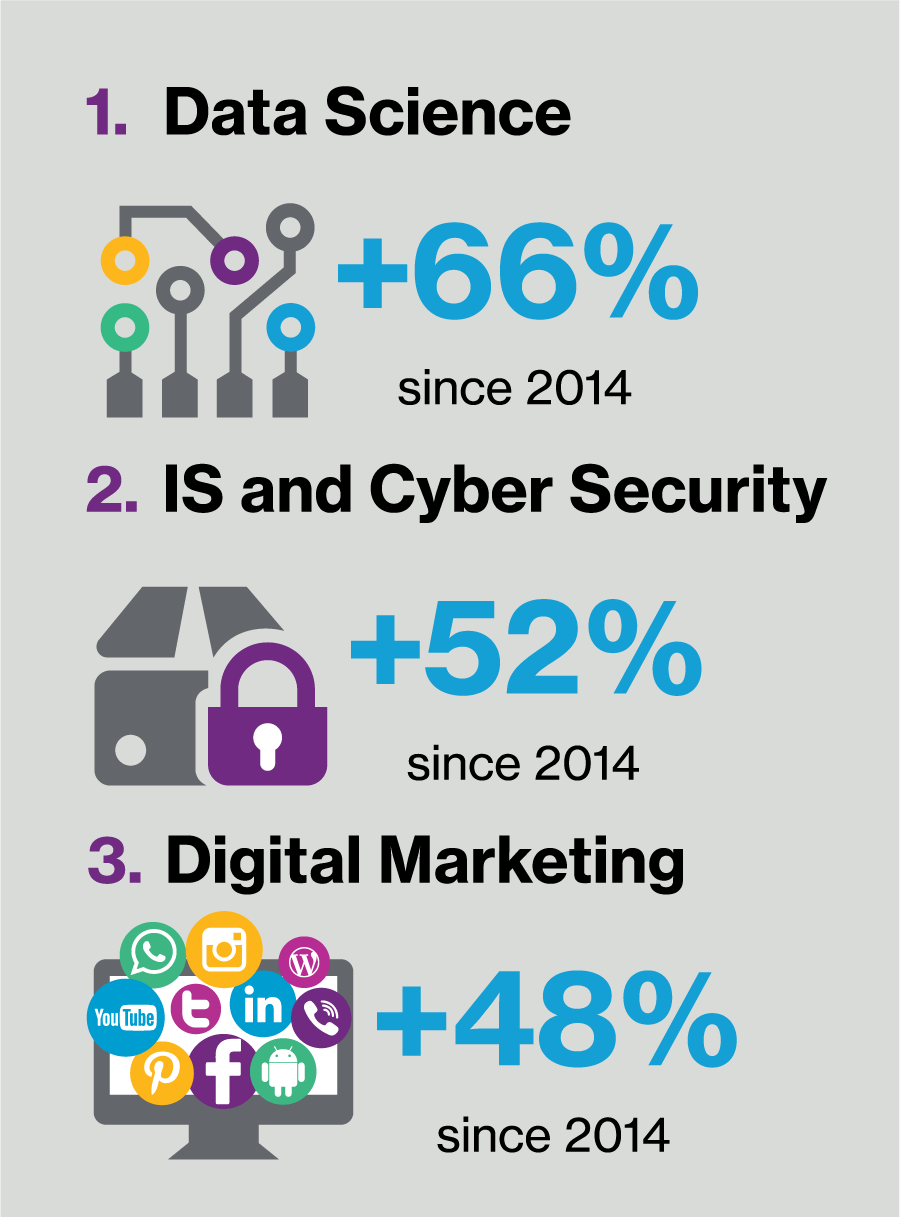

A good example is Singapore. The past five years have seen incredible growth in demand for key IT skills2 such as data science, Information Systems and cyber security as well as digital marketing (Figure 2).

This has created a situation where this type of specialised talent is highly sought after across a broad range of industries as organisations across the market race to digitalise. The rate of voluntary attrition in Singapore is close to 14%. It's a compelling opportunity for employers to think about new and innovative ways to engage and retain employees, and one of the levers they can pull is to create a portfolio of attractive and personalised benefits. For employees, this could be the differentiating factor between one employer and another.

Apart from the need to attract diverse talent due to digitalisation, other factors are contributing to the demise of the "one size fits all" approach to employee benefits.

Generational diversity: According to the UNFPA, one in every four people in the Asia Pacific region will be over 60 years old by 20503. This ageing population is a growing concern for employers, as it creates various complexities in the workforce, including challenges in succession planning and work re-design as older employees stay longer in the workforce.

In addition, Generation Z workers who are entering the market alongside older generations will have very different priorities with regards to their benefits. Younger generations generally respond more to wellbeing and lifestyle benefits such as gym memberships and flexible work arrangements, while older employees may be more concerned about costs of medication for chronic conditions.

Contingent workforces: The rise of technology, while changing the nature of work, has also changed the way work is performed. The rise of online talent platforms, alternate working arrangements and the contingent workforce is allowing employers to source talent from more diverse sources than ever before: today, 19% of employers say automation currently enables or requires them to use more nonemployee talent, such as free agents or contractors. However, this number jumps to half when looking forward to the next three years4.

On the one hand, this means a richer talent pool to choose from, and the ability to extend the workforce beyond the physical location of the organisation. However, it also creates a challenge for employers in terms of how to ensure these workers are engaged and feel that the employee value proposition is just as relevant to them as it is to full-time employees who sit in the office.

All these factors taken together clearly present a challenge for employers when modernising their benefits: to create a portfolio of benefits that is relevant across a variety of employee groups, ages and geographies, flexible, yet strong enough to be a significant attraction and retention factor for employees.

Understanding your workforce is crucial to modernising your portfolio

The employee is increasingly at the centre of how we design a benefits program. In Asia Pacific, 61% of employers said that it was a priority to align their benefits provisions with not only market norms, but also employees' wants and needs, and 82% will take action in the next three years to address the wants and needs of their workforce.5 With this move to a greater internal focus, the employee is increasingly being seen as an individual consumer in his or her own right.

By segmenting their employees — just as they would a consumer base — there is enormous potential for employers to ensure the benefits they provide are relevant, timely and meet the diverse needs of their workforce.

One important way to understand your workforce needs is ensuring they have opportunities for their voice to be heard. Be it formal surveys, crowdsourcing, assessments, town halls or other feedback vehicles, empowering your employees (and providing the channels) to speak up provides you valuable feedback about whether your benefit strategies are going in the right direction.

Building a strong foundation

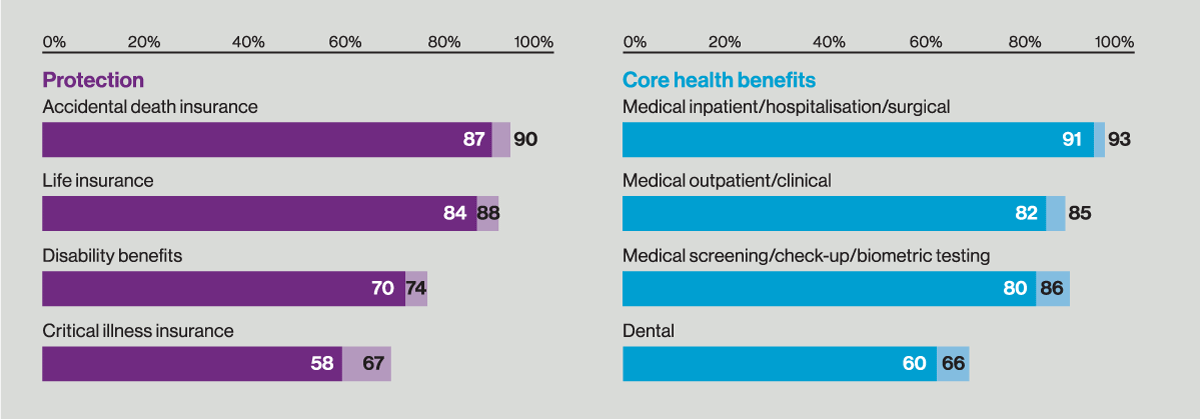

In addition to looking inwards, there's also an enduring focus on the fundamentals. In an environment where employees are vulnerable to changes in the workforce and volatile economy, core benefits play a strong role in making them feel valued and secure. These areas include:

However, to truly adapt to the workforce of the future, we must go beyond core benefits. Here's where the use of segmentation and understanding your workforce comes in handy; using that knowledge, it becomes easier to design a targeted benefits package that covers core benefits and goes beyond in offering programs that are relevant across diverse groups of employees. In offering flexibility and choice, employers will not need to offer benefits across the entirety of the workforce, which would be costly and irrelevant to many. Instead, it allows employers to demonstrate to employees that they are listening, and empowering them to build their own personalised benefits program.

Source: 2017/2018 Asia Pacific Benefit Trends Survey: Benefit Strategies for tomorrow's workforce

Our 2019 survey found that two-third of employers are confident that they understand their employees' needs — yet, less than half say their benefits package is tailored to meet employees' needs5.

This could be a missed opportunity, as offering the appropriate flexibility and integrating choice in benefits has been proven to drive value and employee engagement.

Offering appropriate flexibility and integrating choice in benefits has been proven to drive value and employee engagement.

Two years ago, our survey found that, of those employers that currently offer flexibility, more than three-quarters said that it demonstrated to employees that the organisation recognises the diverse needs of the workforce, and promotes employee appreciation and understanding of their benefits. Almost two-thirds (63%) also said it helped with attraction and retention6.

Cost and administrative hurdles

Historically, employers have been reluctant to foray into offering flexibility because of the perception of accompanying cost and administrative complexity. However, advances in technology today allow us to overcome these obstacles in a cost-effective way. Delivering a benefits program with a user-friendly online portal and targeted communications makes it easier for employees to understand and enrol themselves in the benefits of their choice, compared to the complicated and manual procedures of the past.

Many may liken the experience to shopping online, for instance — picking the benefits you want, understanding how much they cost, and having control over the entire process yourself. Once the structure is set up, it's also less of an administrative burden for HR, and will in addition provide a richness of data that feeds into insights for utilisation, claims data, and many other data sets that allow employers to run their benefits programs more efficiently in the future.

Above all, the modernisation of the benefit portfolio relies on aligning benefits with the evolving values and preferences of the new workforce. When executed well, it has advantages for both the employer and employee. On the employer side, benefits strengthen and align with organisational culture and values, as well as promote employee engagement and accountability.

And as for employees, they will find that they can access benefits that are personalised to their specific circumstances and can meet their needs at different life stages.

1 Willis Towers Watson 2017/2018 Global Future of Work Survey — Asia Pacific

2 2019 Beyond Data HR Priorities: Singapore spotlight

3 UNFPA Asia & the Pacific: Ageing

4 2017 Future of Work survey: Debunking myths and navigating new realities

5 2019/2020 Asia Pacific Benefit Trends survey

6 2017/2018 Asia Pacific Benefit Trends survey: Benefit strategies for tomorrow's workforce

For more information, or for a demo of Benefits Marketplace, the Willis Towers Watson solution that offers the power of choice where it matters, please contact:

| Title | File Type | File Size |

|---|---|---|

| Modernizing Benefits in Asia Pacific - Part 2 | 8.2 MB |