Are you viewing your Total Cost of Risk (TCOR) solely from a budgetary perspective? Move beyond the typical year view, evaluate the impact of variability across multiple risks and assess the benefits of alternative structures with Dynamic TCOR.

Without the right data and analytics, it’s hard to know whether your organization is over or under-hedged, how volatile your cost of risk could prove, and whether your risk financing is aligned with organizational risk tolerance.

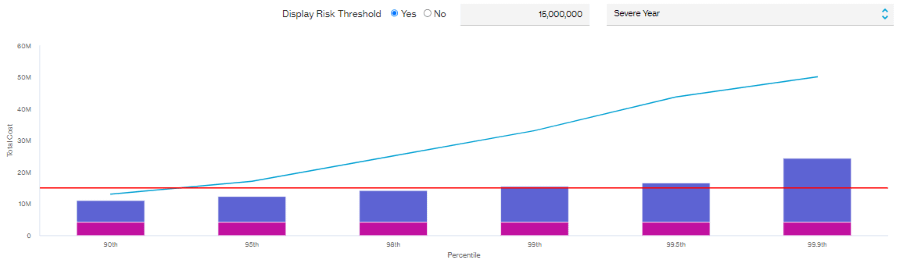

Dynamic Total Cost of Risk (TCOR) delivers answers by quantifying the cost of risk across a range of likelihoods, empowering you to evaluate the value derived from both your existing and potential alternative transfer strategies.

Inform your risk finance program with risk analytics

Because this powerful tool is informed by WTW’s suite of risk analytics, Dynamic TCOR gives you data-driven confidence on the benefits and rationale of your risk and insurance approach.

It delivers concise, quantifiable assurance on how often you can expect to transfer losses, and on the impact of different retentions and limits.

By using risk analytics to move beyond simplistic evaluations on the value from insurance, you prepare your organization to take a more proactive stance when approaching markets, as well as search for hidden value.

Quantify the value of your total cost of risk

Dynamic TCOR offers the data analytics insight to:

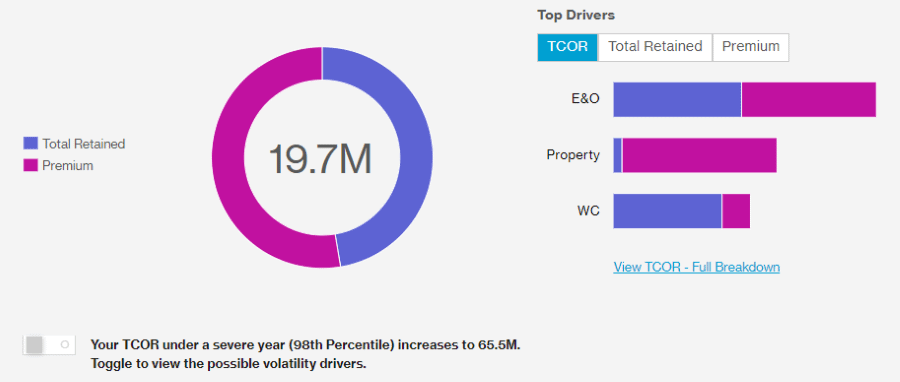

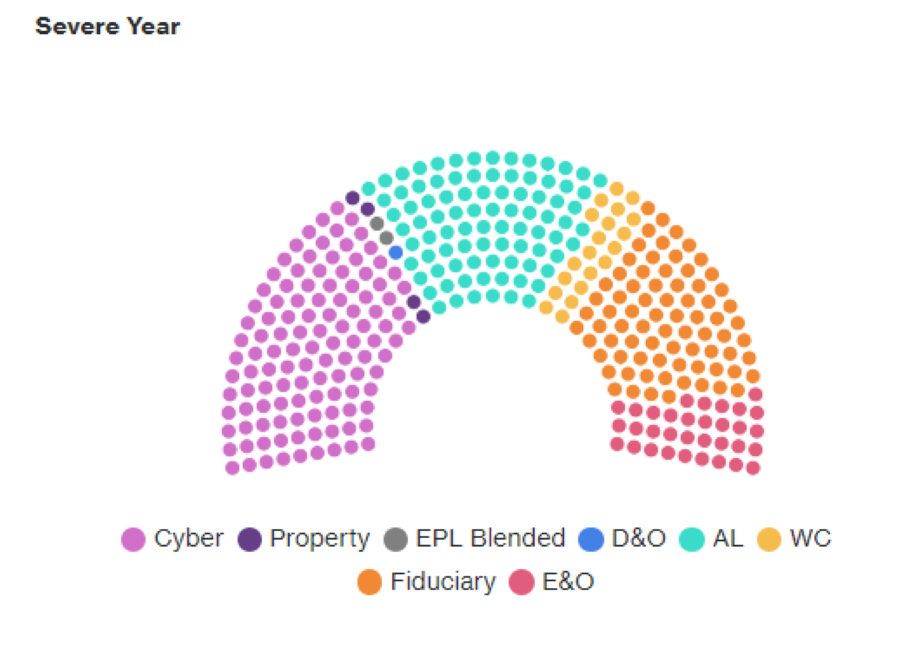

- Evaluate risk holistically by assessing retained loss outcomes across all major coverages

- Define which insurance classes are driving the total cost of risk and make targeted adjustments to your insurance program

- Understand loss volatility for each class of insurance through a connected suite of risk-specific models

- Explore alternative insurance strategies and dynamically view the corresponding impact on volatility and TCOR

- Assess how closely your risk finance program is aligned to with risk tolerance

- Communicate the value created by your insurance strategy and spend with a concise scorecard you can share with stakeholders.

While insurance placements can be siloed, with different teams looking at individual lines, Dynamic TCOR encourages collaboration and enables organizations to think about total risk more strategically.

TCOR delivers answers by quantifying the cost of risk across a range of likelihoods, empowering you to evaluate the value derived from both your existing and potential alternative transfer strategies.

How and when to use Dynamic TCOR

Use Dynamic TCOR when looking to understand your total cost of insurable risk, across the organization. Compare TCOR to your organization’s risk tolerance to ensure that retained losses do not exceed acceptable levels of risk.

You can use Dynamic TCOR in preparation for approaching markets at renewal or when you’re considering changes to individual insurance coverages.

By using Dynamic TCOR to regularly monitor and quantify your total cost of risk, you can both be better prepared to evaluate the pricing of quotes and options and be ready to share data-driven insights to internal stakeholders such as treasury and the c-suite throughout the insurance cycle.

The tool can also uncover the risks that would benefit from a deeper-dive analysis and form the foundation for moving towards nuanced portfolio view of risk with expert support from WTW as required.

Dynamic TCOR: Key features

- Delivers advantages for any company buying insurance and seeking to explore the risk/return equation.

- Works for organizations globally in any country

- Includes the main insurance classes that apply internationally and in the U.S.

- The tool is constantly updated with WTW’s proprietary risk analytics.

To discover more on how Dynamic TCOR and WTW suite of risk analytics can reveal smarter ways to quantify and maximize your risk, get in touch.