Total global alternative assets under management swells to almost $6.5 trillion

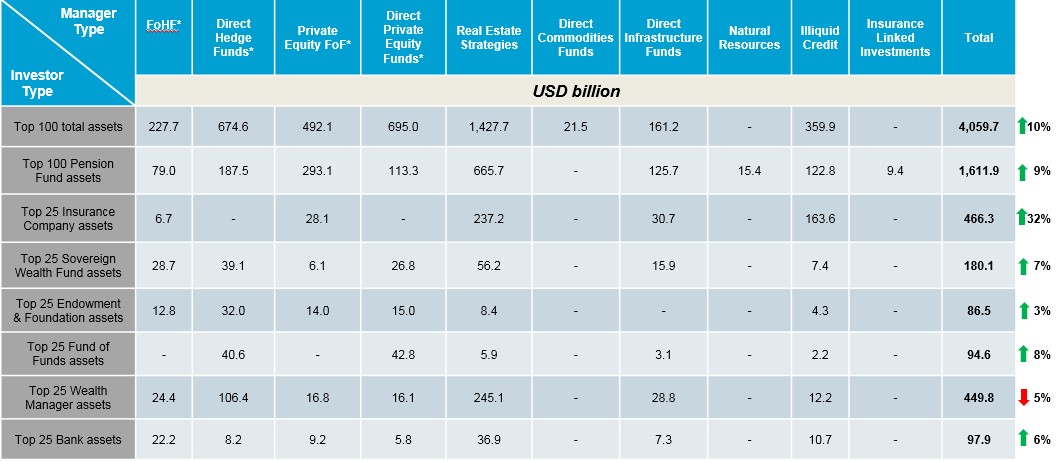

LONDON – Monday, 17 July, 2017 – The world’s largest 100 alternative asset managers saw assets under management increase by 10% in 2016, rising to $4 trillion, according to the 2017 edition of Willis Towers Watson’s Global Alternatives Survey. The survey, which captures long-term institutional investment trends by seven main investor groups across ten alternative asset classes, showed that of the top 100 alternative investment managers, real estate managers have the largest share of assets (35% and over $1.4 trillion), followed by private equity fund managers (18% and $695bn), hedge funds (17% and $675bn), private equity funds of funds (PEFoFs) (12% and $492bn), illiquid credit (9% and $360bn), funds of hedge funds (FoHFs) (6% and $228bn), infrastructure (4% and $161bn) and commodities (1%).

In terms of the growth by asset classes among the top 100 asset managers, illiquid credit saw the largest percentage increase over the 12-month period, with AuM rising from $178bn to $360bn. Conversely, assets allocated to direct hedge fund strategies among the top 100 asset managers fell over the period, from $755bn to $675bn.

Notably, insurance company assets managed by the top 100 alternative asset managers grew from 10% to 12% of total assets.

Luba Nikulina, global head of manager research at Willis Towers Watson, said: “As capital supply and competition have increased in some segments of the illiquid credit universe, such as direct lending for example, yields are not always offering sufficient compensation for illiquidity and risk. At the same time, we have seen some withdrawal of capital from hedge funds in the face of high fees, skewed alignment of interests and performance headwinds. It appears that the growing groundswell of negative sentiment that has arisen due to the aforementioned issues is now showing up in the decisions of asset allocators. We have been surprised it has taken this long to observe the trend turn, however this is aligned with our long-held view that the hedge fund industry needs to change, with those willing to offer greater transparency and display value for money likely to prosper going forward.”

Data for the total alternative investment universe, shows that overall alternative assets under management now stand at just under $6.5 trillion, across 562 entries. North America continues to be the largest destination for alternative asset manager allocations (54%). Overall, 33% of alternative assets are invested in Europe and 8% in Asia Pacific, with 6% invested in the rest of the world.

The research also highlights that, when looking at the distribution of assets within the top 100 alternative asset managers by investor type, pension fund assets represent a third (33%) of assets. This is followed by wealth managers (15%), sovereign wealth funds (5%), endowments & foundations (2%), banks (2%) and funds of funds (2%). Notably, insurance companies’ proportion among the top 100 alternative asset managers grew from 10% to 12% of total manager assets.

“Although the alternative asset manager universe continues to be dominated by pension fund assets, as solutions have continued to evolve that are better aligned to investor needs and incorporate lower cost structures, we have seen growing interest from other investor groups such as insurers looking to lock-in alpha opportunities presented by continued volatility,” said Luba Nikulina.

Pension fund assets managed by the top 100 alternative asset managers now stand at $1.6 trillion, up 9% compared to last year’s study, and represents 51% of their total AuM. Allocations to illiquid credit by pension funds doubled to 8% in 2016, while real estate retains the largest share of pension fund assets with 41%. This is followed by private equity FoFs (18%), hedge funds (12%), infrastructure (8%), private equity (7%) and FoHFs (5%).

“Despite the elevated levels of macro and political concerns, long lease property strategies in Europe have continued to see interest from de-risking pension funds given the expected return differential relative to bonds and higher inflation expectations. We believe this demand is likely to persist as long as bond yields remain low which makes the ability to source attractive assets in this area ever more important,” said Luba Nikulina. “Private equity has also continued to thrive following the period of strong distributions and investors looking for alpha which is becoming more challenging to achieve with the abundance of capital and limited supply of deals contributing to incredibly rich pricing. Investors are now having to find areas of the market that aren’t as expensive or are viewed as contrarian in hopes of achieving successful outcomes.”

According to the latest data in the research, Bridgewater Associates is the largest manager in terms of overall assets under management, with over $116 billion invested in direct hedge funds. TH Real Estate – an affiliate of Nuveen, the investment management arm of TIAA – is the largest real estate manager globally, overseeing more than $105 billion in assets, whilst Blackstone continues to look after the highest volume of private equity and FoHF assets at just over $100 billion and $71 billion respectively. Prudential Private Placement Investors is the most significant illiquid credit manager with nearly $81 billion under management.

| Rank | Name of parent organisation | Country | AuM US$million | Asset Class |

|---|---|---|---|---|

| 1 | Bridgewater Associates | United States | 116,764.20 | Direct Hedge Funds |

| 2 | TH Real Estate (1) | United States | 105,488.98 | Real Estate Strategies |

| 3 | Blackstone | United States | 101,963.00 | Real Estate Strategies |

| 4 | Blackstone | United States | 100,192.00 | Direct Private Equity |

| 5 | Macquarie Group | Australia | 96,161.72 | Direct Infrastructure Funds |

| 6 | PGIM (2) | United States | 94,583.99 | Real Estate Strategies |

| 7 | Prudential Private Placement Investors | United States | 80,860.40 | Illiquid Credit |

| 8 | CBRE Global Investors | United States | 78,200.00 | Real Estate Strategies |

| 9 | UBS Asset Management | Switzerland | 78,031.00 | Real Estate Strategies |

| 10 | TPG Capital** | United States | 72,000.00 | Direct Private Equity Funds |

| 11 | Blackstone | United States | 71,119.70 | Funds of Hedge Funds |

| 12 | AQR Capital Management | United States | 69,175.00 | Direct Hedge Funds |

| 13 | J.P. Morgan Asset Management | United States | 61,346.40 | Real Estate Strategies |

| 14 | Principal Global Investors | United States | 60,640.00 | Real Estate Strategies |

| 15 | Kohlberg Kravis Roberts & Co. | United States | 58,398.80 | Direct Private Equity Funds |

| 16 | AXA Investment Managers | France | 56,506.60 | Real Estate Strategies |

| 17 | Man Group | United Kingdom | 54,668.00 | Direct Hedge Funds |

| 18 | Brookfield Asset Management | Canada | 54,642.00 | Real Estate Strategies |

| 19 | Hines | United States | 54,004.00 | Real Estate Strategies |

| 20 | LaSalle Investment Management | United States | 53,160.00 | Real Estate Strategies |

| 21 | Goldman Sachs Asset Management | United States | 52,183.34 | Private Equity FoF |

| 22 | AEW (3) | United States | 50,996.00 | Real Estate Strategies |

| 23 | The Carlyle Group** | United States | 50,864.00 | Direct Private Equity Funds |

| 24 | Providence Equity Partners** | United States | 50,000.00 | Direct Private Equity Funds |

| 25 | Advent International | United Kingdom | 48,932.00 | Direct Private Equity Funds |

* Data derived from the Global Billion Dollar Club, published by HedgeFund Intelligence

**Figures show total assets under management, obtained from publicly available sources

(1) TH Real Estate is an affiliate of Nuveen (the investment management arm of TIAA)

(2) The assets reported here reflect those of the PGIM Real Estate and PGIM Real Estate Finance divisions

(3) AEW Capital Management is an affiliated investment management firm of Natixis Global Asset Management, thus contributing to the illustration of Natixis' overall capabilities in global alternative offerings

* Figures for some of these managers were obtained from publicly available sources and using data derived from the Global Billion Dollar Club, published by HedgeFund Intelligence

Willis Towers Watson conducted this survey for the year to December 2016 to rank the largest alternative investment managers and includes 562 investment manager entries comprising: 121 in hedge funds, 102 in real estate, 75 in private equity, 60 in illiquid credit, 58 in infrastructure, 46 in private equity fund of funds, 39 in fund of hedge funds, 23 in commodities, 22 in natural resources and 16 in insurance-linked investments. For real estate, commodities and infrastructure, individual managers are included. The majority of the data comes directly from investment managers with the remainder coming from publicly available sources. Certain individual hedge fund information was sourced from the Global Billion Dollar Club, published by Hedge Fund Intelligence. All figures are in US$.

Willis Towers Watson’s Investment business is focused on creating financial value for institutional investors through its expertise in risk assessment, strategic asset allocation, fiduciary management and investment manager selection. It has over 900 colleagues worldwide, assets under advisory of over US$2.3 trillion and over US$87 billion of assets under management.

Willis Towers Watson (NASDAQ: WLTW) is a leading global advisory, broking and solutions company that helps clients around the world turn risk into a path for growth. With roots dating to 1828, Willis Towers Watson has 40,000 employees serving more than 140 countries. We design and deliver solutions that manage risk, optimize benefits, cultivate talent, and expand the power of capital to protect and strengthen institutions and individuals. Our unique perspective allows us to see the critical intersections between talent, assets and ideas – the dynamic formula that drives business performance. Together, we unlock potential.