Employment Practices Quantified is a powerful analytical tool that quantifies any combination of employment practices liability (EPL), wage and hour (W&H) and private or nonprofit directors and officers (D&O) loss potential. Insights from our proprietary data and analytics empower your organization to measure and predict risk, as well as provide the decision support needed to optimize your risk management budget and strategy.

Employment Practices Quantified is designed for all organizations: public, private or nonprofit. For public companies, the model focuses on EPL and W&H exposures. For privately-held and nonprofit organizations, the model not only incorporates the EPL and W&H analysis, but also quantifies D&O Liability exposures, creating the ability to evaluate any combination of these three risks.

Employment Practices Quantified's refined evaluation of your organization's comprehensive risk includes:

- Valuable insights beyond benchmarking into company-specific drivers of risk

- Dynamic and customizable technology, delivering instantaneous results

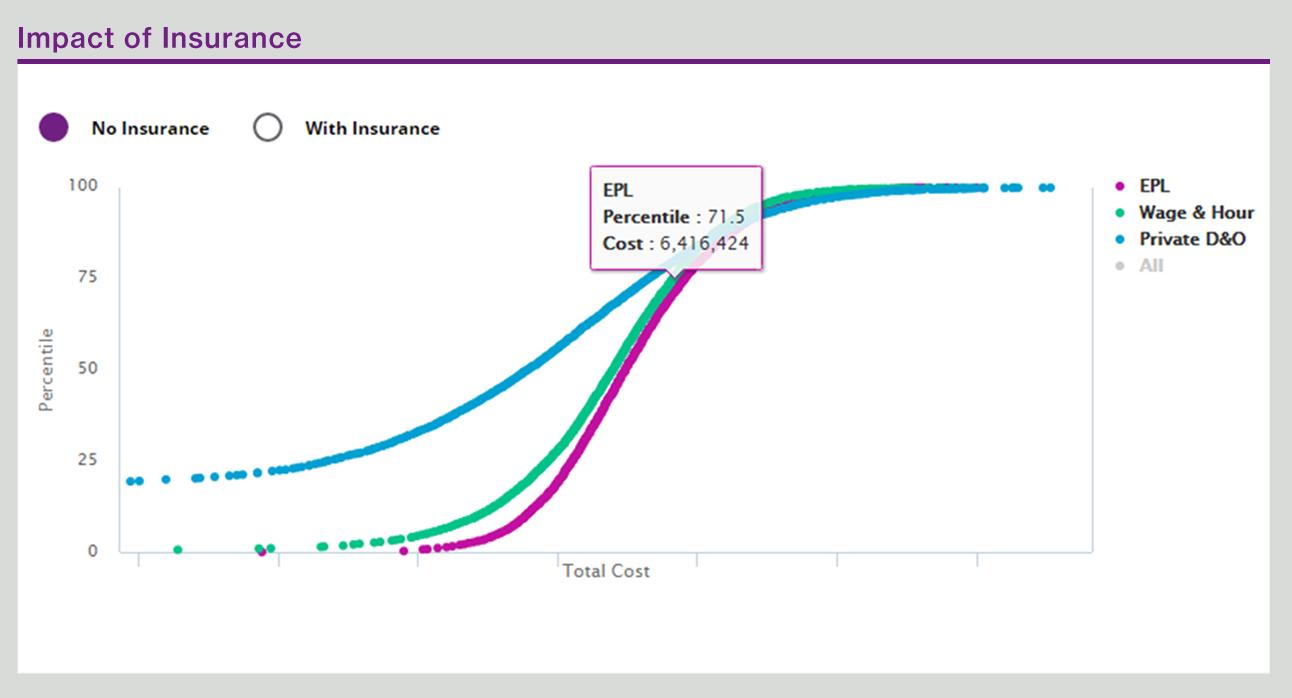

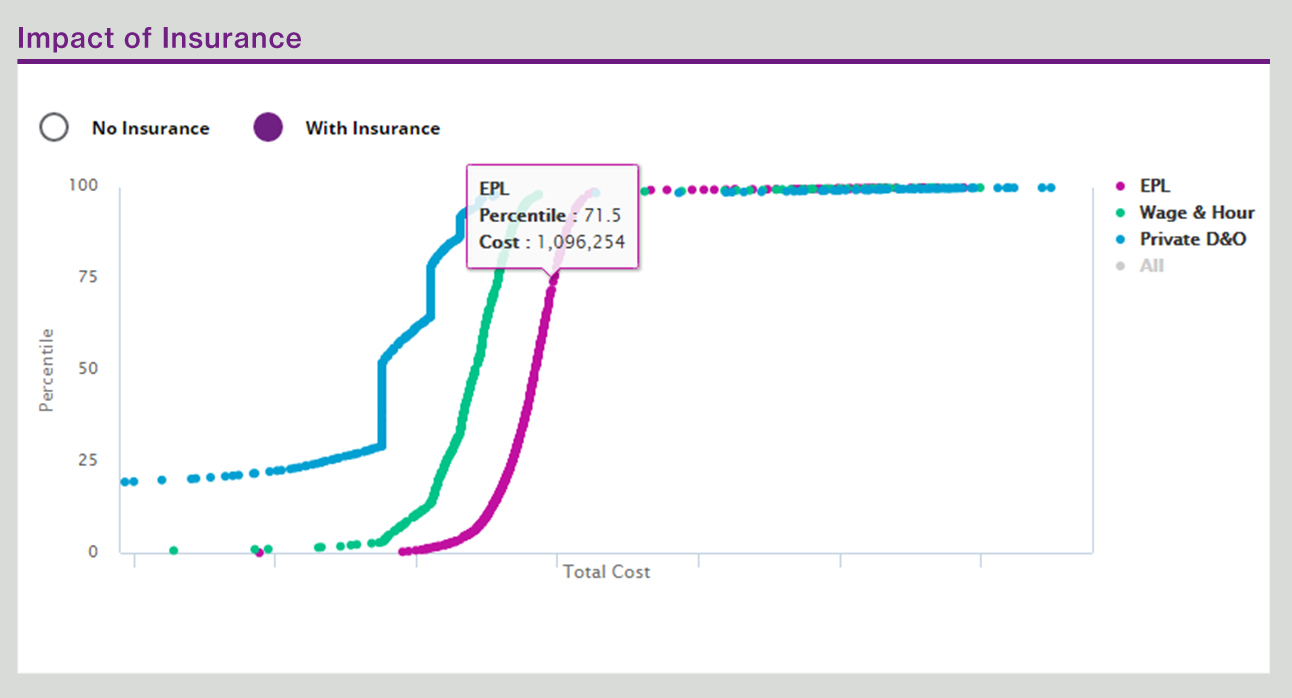

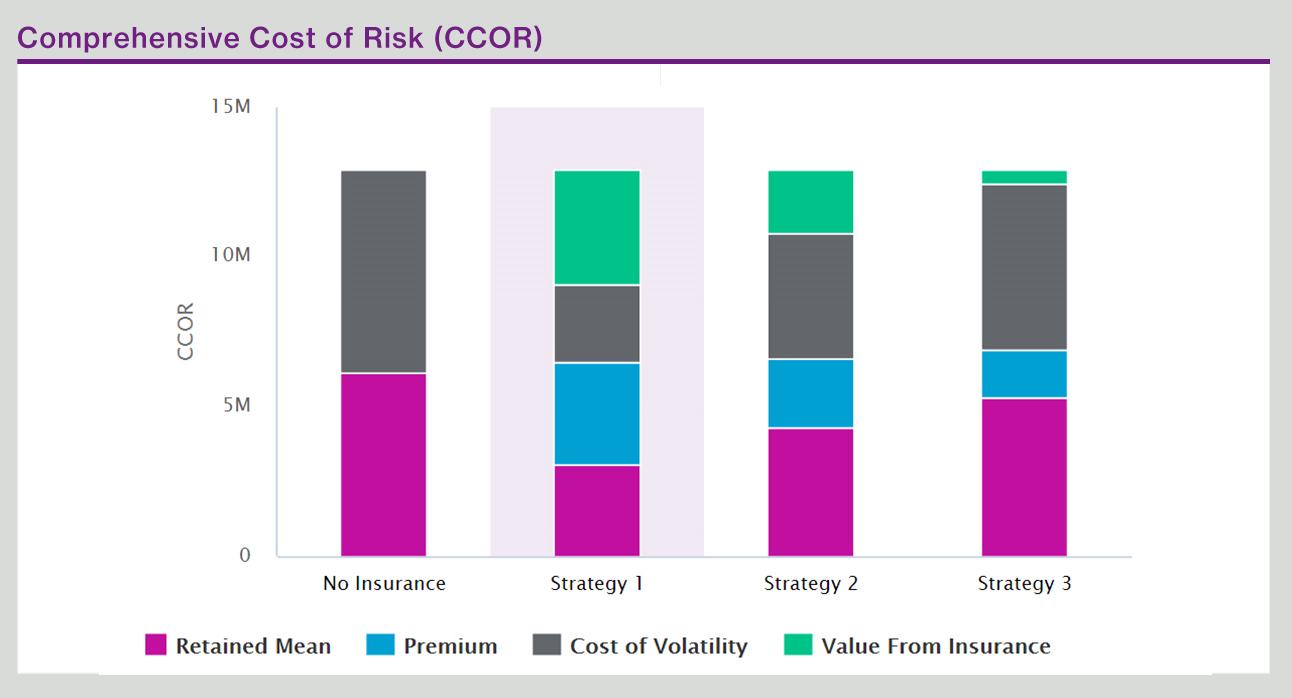

- Data-driven decision support that guides insurance strategy via comprehensive cost of risk (CCOR), limit adequacy, retention/deductible analysis and premium return on investment analysis

- Facilitation of optimal engagement in the insurance marketplace

- Concise and compelling output for efficient communication with internal stakeholders

Impact of Insurance