Free up time and resources to focus on strategic decisions

It is undoubtedly every asset owner’s objective to make better decisions, build better portfolios, and thus drive better outcomes. Yet, when it comes to the decision-making process, three worrying observations are worth-noting.

Three worrying observations

First, many failed to match the investment governance budget with the sophistication of the portfolio strategy, which is vital to investment success. Insufficient time devoted to investment matters and the lack of broad and up-to-date expertise or knowledge may hinder organizational effectiveness for making and implementing timely decisions to capture market opportunities, limiting investment returns.

Second, asset owners often focus too much on the details, but not much on the strategic decisions. In particular, a disproportionally large amount of effort and time is often spent on monitoring the portfolio, when it is more efficient if spent on defining and reviewing the fund’s investment objective and risk and return targets.

Third, many are often reluctant to step out of the herd. Many of our clients think too much on how others are doing, but not much on what they should do. Yet, in today’s competitive market environment, every percent of alpha return requires actions that stand out from the cd so the mind-set of keeping up with the peers is just not sufficient anymore.

Up your game or simplify

To address the three aforementioned concerns, there are a couple of options, depending on the investment governance budget and resources available. For asset owners facing a gap between governance level and the sophistication of the portfolio strategy, it is a case of ‘simplify your strategy or raise your game’. They may either settle for simpler passive-like portfolios to reduce costs and free up governance budget for other investments, or build up the governance, resources and capabilities required if higher potential returns are what they are after.

For those who want to ‘raise their game’ and improve the risk-return trade-off from portfolios of equities and bonds, there are generally two options available to add to investment governance – either building an in-house team or delegating to a fiduciary manager.

Building an in-house team is more efficient if the organization embodies the five factors as follows:

| Access | in-source if you can get better access to asset classes or markets than widely available vehicles can offer you |

| Alignment | in-sourcing can be a useful means of minimising agency problems and ensuring that your investments are structured to meet your goals and not those of an asset manager |

| Capabilities | improving your internal resources can upgrade the capabilities of your organisation |

| Performance | maximizing net-of-fee returns |

| Sustainability | in-sourcing can offer the opportunity to tailor your investments to meet your needs through time, better than a combination of available mandates |

(See The Scope of Financial Institutions: In-Sourcing, Outsourcing, and Off-Shoring, Clark and Monk, 2012)

Building an internal team can offer attractive benefits. However, for many it is simply not a realistic solution as only the largest funds (perhaps US$10 billion and above) have sufficient scale to make this a genuinely viable option. This may be surprising, but the ideal environment for a sustainable in-house team requires substantial resource, collaboration and idea generation.

For funds that cannot afford to build internally, fiduciary management is a means of addressing the gap that exists between the need for increasingly efficient investment strategies and real-time decision making, and the typically constrained governance budget of a board or investment committee.

Delegation – A complement, not replacement

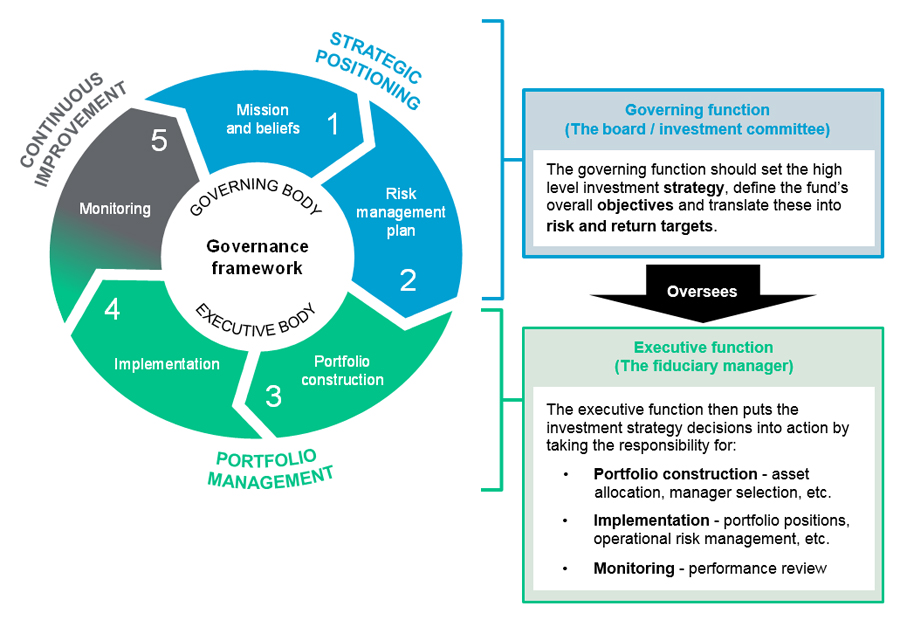

Delegation to a fiduciary manager allows organizations to gain access to resources and expertise required for efficient and timely execution of investment strategies that are otherwise too costly or impossible to build up in-house. However, asset owners may hesitate to delegate their portfolio to an external party in fear of losing control over the investment decisions and the management of the fund. Our house view, fortunately, is that the governing function, represented by the board, and the executive function, taken up by the fiduciary manager, should be separated and thus the board can retain its control and oversight over the whole portfolio.

As shown in the typical investment cycle below, the board or investment committee remains in control of the high-level strategy, defining the fund’s long-term objectives and determining the return requirements, while the fiduciary manager takes on the day-to-day implementation aspects, including portfolio construction and operations.

Portfolio construction, implementation and monitoring require specialist resources and expertise and is therefore managed by an internal team led by a Chief Investment Officer (CIO) or similar. For investors that do not have the scale or resources to merit the costs of an in-house CIO, they could delegate portfolio construction and implementation to a fiduciary manager who act as a delegated CIO.

Delegation to a fiduciary manager can complement the strategic responsibilities of the governing function. With delegation in place, investors have more time for strategic decision making, but importantly, more time to focus on high quality oversight.

Choosing an implementation route for delegation

There are a large number of fiduciary management options available to investors. The benefits of a bespoke approach and the simplicity offered by a pooled fund’s route should both be explored. Of course, with some fiduciary managers, it may also be possible to combine investment in some funds with a bespoke mandate in other areas to harness the benefits of both.

| Pooled fund containing wide range of assets |

|

| Pooled funds for specific opportunities |

|

| Segregated implementation |

|

For a segregated implementation, the fiduciary manager enters into a separate agreement with each asset manager on the client’s behalf. This allows for more tailoring of the eventual portfolio to the investor’s particular needs. In addition, there are various different issues to be taken into account when deciding whether a pooled fund route or a bespoke route would be more suitable, such as investment restrictions, portfolio construction and management issues, as well as cost and liquidity concerns.

Key takeaways

Aligning desired portfolio strategies with the governance budget and resources required is of paramount importance yet often neglected. If there is a mismatch, the asset owner may either simplify the portfolio or step up the game by building an in-house investment team or delegating to a fiduciary manager. As most funds do not have the sufficient scale to justify the cost of building an internal team, delegation may be the more viable option.

Fiduciary management reduces the implementation and monitoring burden of the board without diluting the board’s control over the portfolio. This frees up asset owners’ time and resources to focus on strategic investment decisions, which leads to better decisions overall, more efficient portfolio management, and eventually better investment outcomes in the long run.

Further information

Please contact your usual Willis Towers Watson consultant or email: investment.solutions.asia@willistowerswatson.com.

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.