Historically, many investors have allocated a large proportion of their equity portfolio to domestic equities, creating a “home bias”. We explain why investors in Asia are (and should be) allocating more to global mandates and reducing the home bias when constructing their equity portfolios.

Reduced risk exposures from global mandates due to diversification

The performance of an equity portfolio with a strong home bias is overly dependent on the performance of the domestic equity market. This in turn depends on the local political and economic environment (market specific risk), specific sectors’ performance (sector concentration risk), as well as the performance of large listed companies within the local market (stock-specific risk).

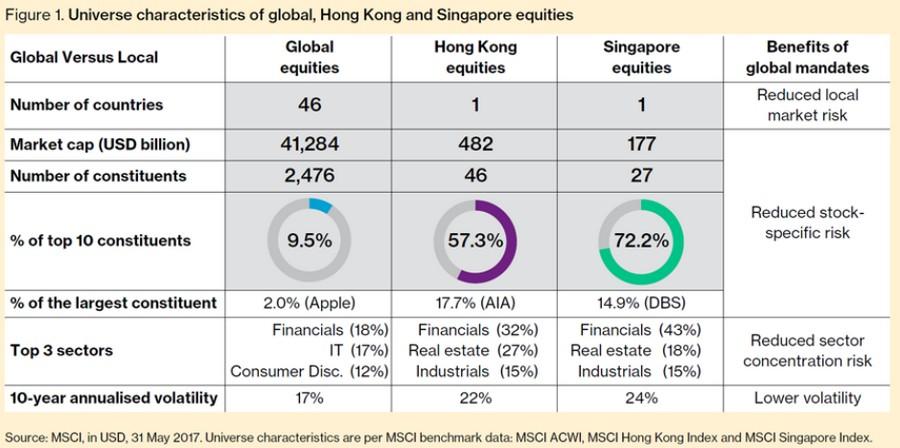

By way of example, Figure 1 below shows the universe characteristics of global equities versus Hong Kong and Singapore equities, as per MSCI benchmark data.

For Hong Kong and Singapore investors, a domestic equity allocation leads to concentrated sector and stock allocations, which translates to higher volatility. For example, changes to the value of AIA (in Hong Kong) and DBS (in Singapore) can have a material impact on the overall equity portfolio. It is also worth noting that the top 10 constituents within the domestic equity market already cover over 50% of the respective universe. In addition, both Hong Kong and Singapore have a very sizeable exposure (c. 60%) to the Financials and Real estate sectors. Therefore, from a risk-perspective, investors in Hong Kong and Singapore should consider allocating to a globally diversified portfolio within their equity allocation (and thus eliminating the home bias).

Lack of inflation protection from domestic equities

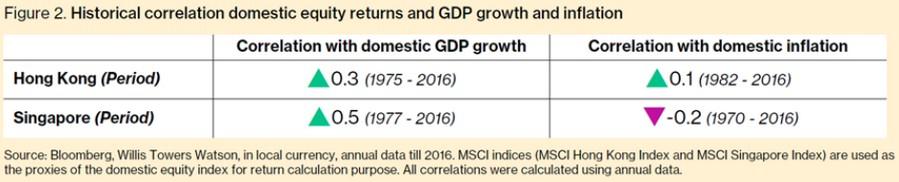

A common argument for holding domestic equities is that it provides a link to the local economy, either reflected in GDP growth or local inflation. In particular, Hong Kong and Singapore investors may have been attracted to a home bias due to a higher GDP growth compared to other developed countries such as the US in the late 20th century. Figure 2 below shows the historical correlation of domestic equity returns with GDP growth, as well as the correlation between domestic equity returns and domestic inflation. While there is modest, albeit positive, support for a correlation between GDP growth and domestic equity returns over the long term, the claimed correlation between domestic inflation and domestic equity returns is non-existent.

Figure 3 shows the historical rolling 10-year correlation between equity market returns and domestic inflation. This provides further evidence that domestic equity returns are not related to inflation. The rolling correlation is not stable over time and ranges from weak negative to modestly positive. A potential reason for the lack of a clear and stable relationship is the increased globalisation of financial and economic markets. Another reason is because of the more frequent and sometimes extreme changes in the equity market valuations, compared with the generally more stable and slower moving inflation measures.

Limited foreign exchange risk from holding global assets

A global equity allocation provides exposure to stocks denominated in foreign currencies, which arguably adds a risk factor. However, compared to the risk arising from equities, the currency risk is immaterial. On a forward-looking basis, we believe the currency risk only accounts for around 5% to 10% of the risk of a global equity portfolio, compared to 90% to 95% arising from equity risk. It is also worth noting there is a very large USD exposure (i.e. over 50%) in the global equity universe.

Going global can enhance alpha

Another main reason to move into global equity from a domestic market, aside from the diversification benefits noted above, would be that global equity investors can equip skillful active managers with the ability to invest across a much wider investment opportunity set. In this way, the investors are not constrained by the limited number of companies in their domestic market, but rather they can invest in the best companies wherever they are located. Generally, we think that the alpha opportunity associated with investing in global equity markets is much greater than investing in a narrow domestic market, such as Hong Kong or Singapore.

Other non-investment related reasons for home bias

The points raised above focus on the investment rationale for moving from a domestic to a global equity portfolio. Some investors may cite non-investment reasons for maintaining a home bias within the equity portfolio. For example, familiarity with local markets, investors wanting to support their local economy (potentially for strategic or political reasons) or the regret risk from not holding domestic assets should the domestic market increase materially. Whilst the validity of these reasons requires an individual assessment, we believe that for many investors the focus should be on maximising their risk adjusted returns and therefore the need for a home bias is often absent.

Conclusion: reconsidering home bias

Following are the four major reasons why we believe Asian investors should reconsider their home bias:

Further information

For further information on this topic, please contact your usual Willis Towers Watson consultant

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.

About Advisory Portfolio Group Asia

Willis Towers Watson has a series of Advisory Portfolio Groups (APG) within the Investment line of business around the globe, based in the Americas, Asia, Australia, the UK and EMEA. The APG in Asia seeks to identify and develop best ideas and approaches that can offer a competitive advantage to Asian institutional investors, while spearheading Asian-focused investment research and portfolio construction advice. Further, the group is responsible for ensuring high quality and consistency of advice, and works with client teams to design portfolios.

This paper was written by members of the APG for general information purposes only.

Produced by:

Louis Tung, CFA, FRM

Senior Investment Analyst

Reviewed for APG by:

Jelmer Veltman, CFA

Senior Investment Consultant

| Title | File Type | File Size |

|---|---|---|

| Portfolio matters: Home sweet home? | .1 MB |