A valuable portfolio building block?

China is one of the world’s most dynamic economies. Measured in many ways China’s importance on the global stage is expanding. The rapid growth but the relatively closed nature of the Chinese economy and capital markets provides not only significant investment opportunity, but also potential diversification benefits from onshore Chinese assets for institutional investors worldwide.

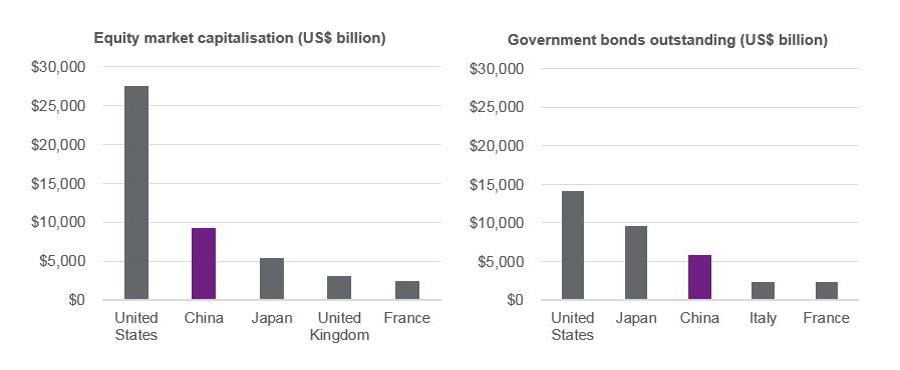

As shown in the chart below, Chinese asset markets rival Japanese markets in size and are clearly second to the US only.

fullscreenEnlarge this Image

Source: MSCI, Bloomberg LP, Willis Towers Watson

Several programmes now exist to allow international investors to purchase Chinese onshore assets. Also major liquid index providers have announced intentions to add Chinse onshore assets to their benchmarks alongside offshore equivalents. We expect the weight of China within mainstream indices and global investor portfolios to increase over time.

The Chinese government is committed to opening up its capital markets to foreign investors. This means that international investors can now access this large and ging set of financial assets that were previously not part of their opportunity set. In our view, this opportunity set cannot be ignored.

In this paper, we discuss why institutional investors should consider an allocation to Chinese assets as a building block within their portfolio. Instead of following index allocations, investors should consider the pros and cons of making an allocation to Chinese assets within their portfolio in the same way that they do with other markets. That is, investors should consider what risk premia are on offer and at what level of risk. As with all investments, we define risk broadly including a consideration of sustainability related factors. Whilst the case for allocating capital to Chinese markets will vary over time, we believe that Chinese assets offer compelling diversification benefits to typical investor portfolios from a strategic view.

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.

| Title | File Type | File Size |

|---|---|---|

| Considering Chinese Assets Asia | .9 MB |