Recent mortality shocks in the UK have led to renewed uncertainty for the trustees and corporate sponsors of pension schemes.

Annual improvements in life expectancy, a constant occurrence for decades, have now stalled since 2011. As a result, those in charge of pension schemes are more unsure than ever about the longevity of their scheme members and the true cost of their pension liabilities. Questions such as "does my mortality assumption truly represent my scheme members?", "what does the future hold?" and "how much risk are we running?" are becoming more common in day-to-day scheme management and triennial valuations as well as longer-term journey planning.

Longevity Focus provides those responsible for running pension schemes with more clarity, certainty and focus over their member longevity. Armed with this, users can set more appropriate mortality assumptions, have greater certainty over future cashflows and better understand the longevity risk facing the pension scheme — important for funding, journey planning, corporate accounting, investment strategy and risk-hedging decisions.

Our team of experts can help you:

- Set more appropriate mortality assumptions

- Have greater certainty over future cashflows

- Explore longevity scenarios

- Better understand the longevity risks facing your pension scheme

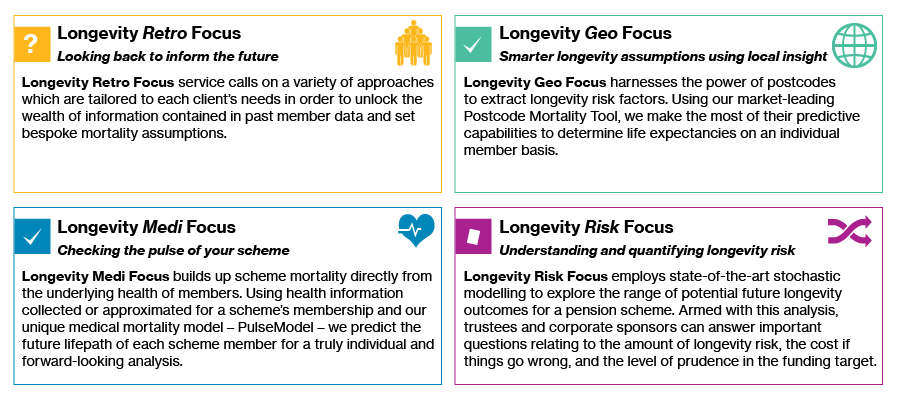

Our Longevity Focus offering is made up of four key components: Longevity Retro Focus, Longevity Geo Focus, Longevity Medi Focus and Longevity Risk Focus.

- Longevity Retro Focus service calls on a variety of approaches which are tailored to each client’s needs in order to unlock the wealth of information contained in past member data and set bespoke mortality assumptions.

- Longevity Geo Focus harnesses the power of postcodes to extract longevity risk factors. Using our market-leading Postcode Mortality Tool, we make the most of their predictive capabilities to determine life expectancies on an individual member basis.

- Longevity Medi Focus builds up scheme mortality directly from the underlying health of members. Using health information collected or approximated for a scheme’s membership and our unique medical mortality model – PulseModel – we predict the future lifepath of each scheme member for a truly individual and forward-looking analysis.

- Longevity Risk Focus employs state-of-the-art stochastic modelling to explore the range of potential future longevity outcomes for a pension scheme. Armed with this analysis, trustees and corporate sponsors can answer important questions relating to the amount of longevity risk, the cost if things go wrong, and the level of prudence in the funding target.