This powerful model performs the stress testing and financial analysis you require without the time or burden to your company resources. It is web-based and interactive, dynamically accounting for a variety of factors relevant to your organization almost instantaneously. Within this uniquely controlled, quick and dynamic platform, you will immediately see the impact of scheduling divestitures, examine loanbacks, stress test your internal rate of return, and assess expanded use.

Benefits include:

- Fast, simple output for clear communication

- Adjusts and performs pro-forma analysis in a live, interactive platform

- Connects to our suite of risk-specific quantification models, providing risk clarification reflecting the breadth of insurable risk

Why should you use Captive Quantified?

- Perform the financial due diligence you require:

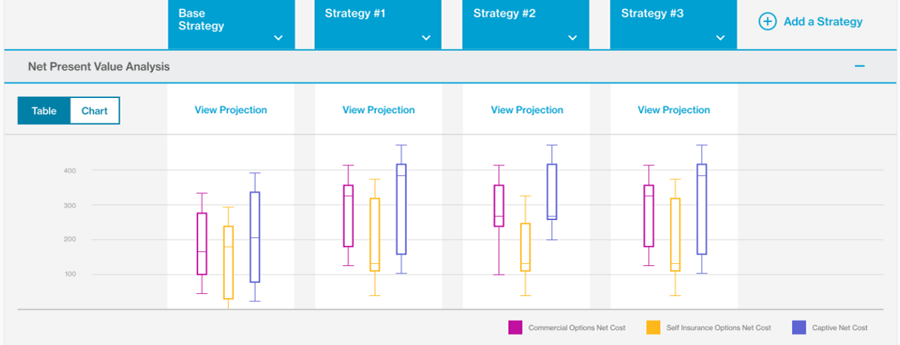

- Detailed interactive value assessment of the captive proposition from the perspectives of both the captive and parent company

- A detailed pro forma analysis of your financials before and after forming a captive

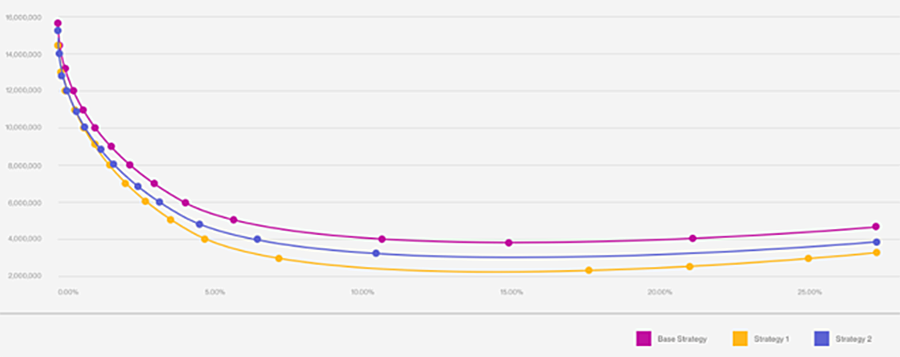

- Live and interactive stress testing: Change any assumption and test any scenario in seconds to evaluate capital adequacy, explore captive expansion and more

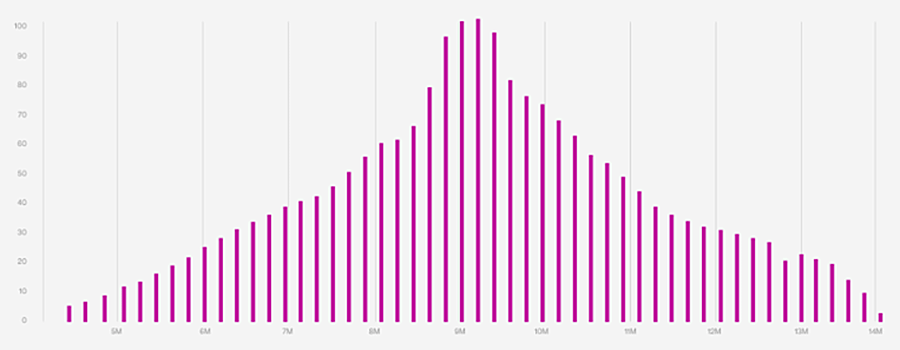

- This model goes a step beyond the typical actuarial inputs you have seen for other captive feasibility modeling. It uses loss projections at confidence levels and in doing so provides a dynamic output sensitive to loss outcome variability

- Examines use and financial planning to project well beyond five years into the future

- Can accommodate the financials of an existing captive to examine changing future use parameters and the associated financial impacts

- Assess nearly anything you can do with the capital that is deployed in your captive, including asset loanbacks and dividends

- Discover the best domicile for your unique needs and preferences

For whom is it appropriate?

- Captive Quantified is designed for companies of all sizes with all sizes of risk.

- There are options to turn on and off IRC 831B (small insurance company election) and 953D (allows offshore insurance companies to be considered U.S. taxpayers)

- This tool is useful for any company that wants to compare the cost of setting up a captive with traditional insurance and retaining risk on the balance sheet.

What geographies does this tool support?

- Captive Quantified is a global tool, supporting all geographies.

- The initial release uses U.S. Generally Accepted Accounting Principles (GAAP) for all pro forma analysis. It also allows four different location-specific parent company perspectives to determine the best domicile for your captive.

- We will add International Financial Reporting Standards in a subsequent release of the tool.

When should you use Captive Quantified? Use this tool:

- When evaluating the feasibility of a new captive or when considering adding or removing risk types from an existing captive

- When considering the most favorable domicile for your captive. This tool evaluates domiciles based on your company profile and priorities

What can I do with information gained from Captive Quantified?

- Assess the potential value proposition of a captive compared to purchasing insurance or retaining risk on the balance sheet

- Identify the best combination of risks to include in your captive with a predetermined level of capitalization – optimize capital deployed to maximize value gained

- Examine the impact of initial capitalization and determine potential future need in recapitalizing the captive

- Discover the best domicile based on your unique needs and financial profile in a dynamic client engagement process

- Stress test any inputs or scenarios in a matter of seconds

Future Enhancements

- We are in the process of adding International Financial Reporting Standards as an alternative to U.S. GAAP.