Chapter one of the FTSE 350 DC Pension Survey 2021

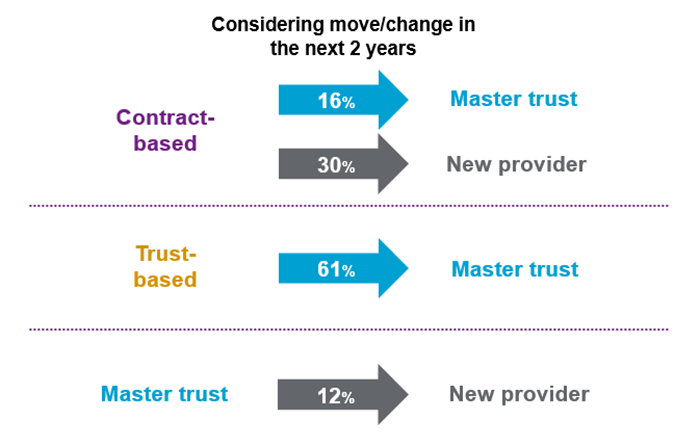

The latest results from our 2021 survey show that 61% of employers running their own trust-based arrangements indicate that moving to a master trust is a consideration in the next two years. Against a backdrop of only 10% of trust-based schemes now delivering defined contribution (DC) in an unbundled manner, this points to a continued trend of seeking both operational efficiency and potentially more efficient and effective support for member retirement saving, both during accumulation and decumulation.

Source: FTSE 350 DC Pension Scheme Survey, 2021

It is also very interesting to note that a secondary master trust market may now start to emerge, beyond the initial move away from trust-based schemes, with survey responses pointing to a potential shift from a contract-based arrangement to a master trust and from one master trust to another. This is not a trend we have seen in our previous surveys, which have historically pointed to a relatively stable contract-based market.

“This years survey provides some interesting insights we’ve not seen before – the possibility of a secondary master trust market emerging and wider savings options and flexibility being opened up for all.”

Simon Hankin | Director, Retirement

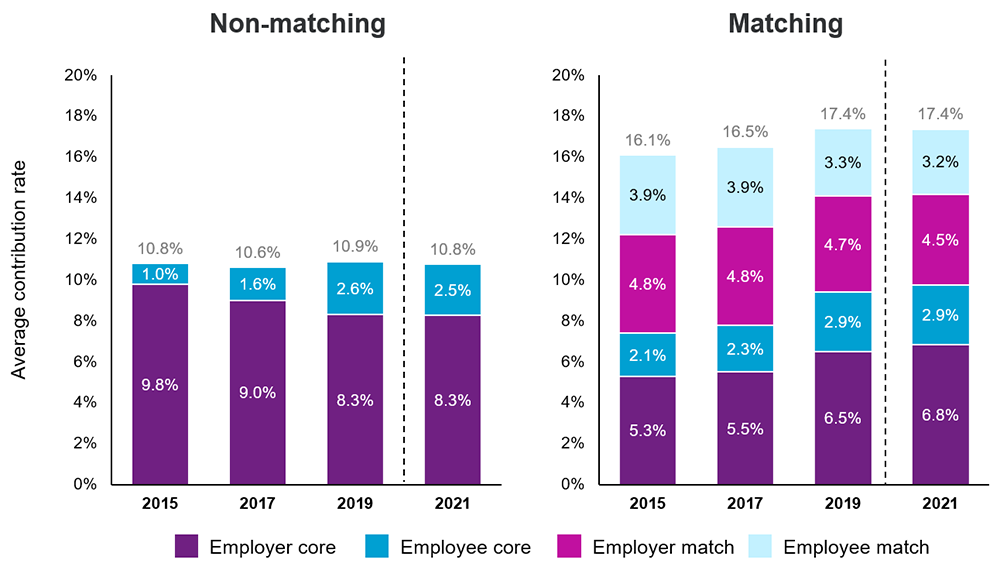

More recently overall contributions levels have remained stable, following a rise in averages in 2019 which was driven by the last phase of increased automatic enrolment contribution levels.

Source: FTSE 350 DC Pension Scheme Survey, 2021

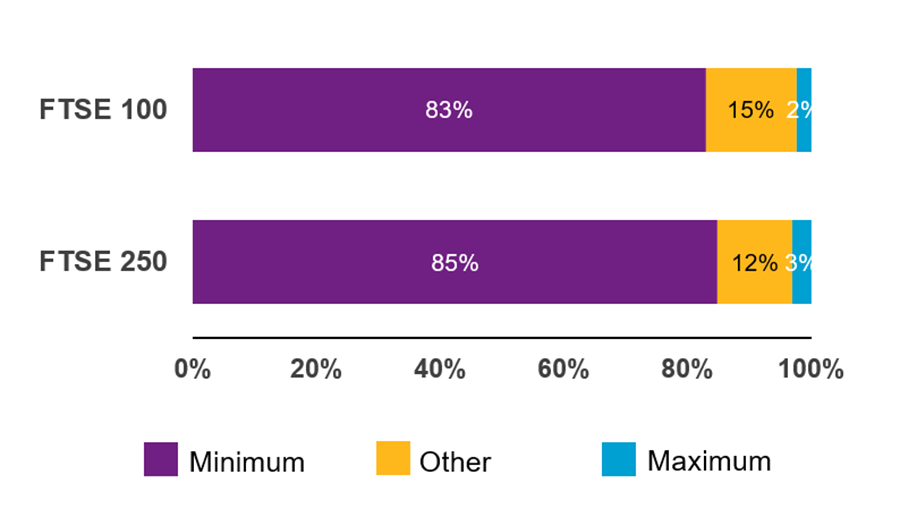

However, we’ve seen again that, where encouraging employee retirement savings is concerned, less than a fifth (20%) of companies enrol members at a contribution rate in excess of the minimum level that exists within their particular contribution structure. There may therefore still be work to do in overcoming inertia in decision making so individuals understand and, where possible, take advantage of more valuable contribution rates to improve their own outcomes.

Source: FTSE 350 DC Pension Scheme Survey, 2021

It will be important to uncover what lies beneath the surface of all this. Changing the method of delivery of pension benefits or switching between providers are not decisions to be taken lightly, but are the concepts of retirement and a pension actually now relics of the 20th century? Will companies develop a more holistic approach, enabling employees to save for the short to medium term rather than just the long term, with solutions for a broad spectrum of expected life and career stages? We have clients who already provide saving options appealing to all their employees – and we are strong advocates of thinking and looking beyond the traditional.

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DC Pension Survey 2021 | 4.9 MB |