Chapter three of the FTSE 350 DC Pension Survey 2021

Investment designs across all scheme types continue to be refined based on how defined contribution (DC) members are expected to access their savings beyond retirement. Investment design increasingly focuses on environmental, social and governance (ESG) factors, with ESG integration into default designs likely to become the norm over the coming years.

It’s seven years since Pension Freedoms revolutionised the retirement landscape, introducing new flexibilities around how benefits are accessed. How DC members will access their savings after retirement continues to be a key consideration in investment design for all scheme types.

“ESG continues to gain significant focus across all scheme types, with 65% already integrating ESG into their investment range.”

Andrew Hope

Director, Retirement

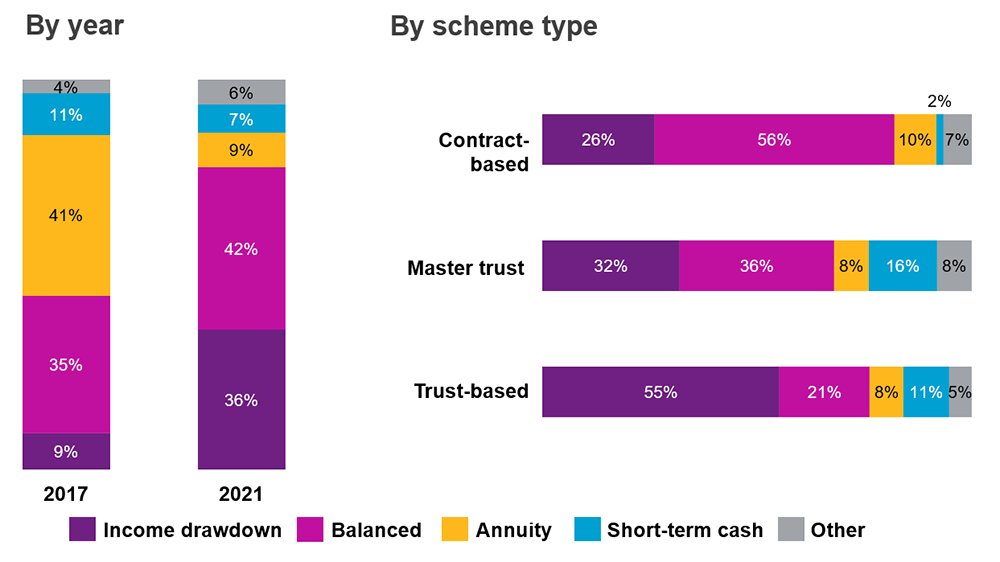

Our survey found that 78% of default investments are now either targeting income drawdown or a more balanced withdrawal approach (up from 44% in 2017).

The proportion of contract-based (56%) and master trust arrangements (36%) targeting a balanced approach was much higher than those within trust-based arrangements (21%). This perhaps reflects the fact that trust-based arrangements are better able to design bespoke investment solutions to meet the specific needs of their membership. Trustees now have several years of retirement decisions to help inform these bespoke designs.

Note: ‘Don’t know’ options excluded. Percentages may not add up to 100% due to rounding.

Source: FTSE 350 DC Pension Scheme Survey, various years

In comparison, employers using contract-based or master trust arrangements are more likely to rely on the provider’s packaged investment solutions. These designs need to cater for a much wider population and therefore tend to be broader in terms of the options they target at retirement.

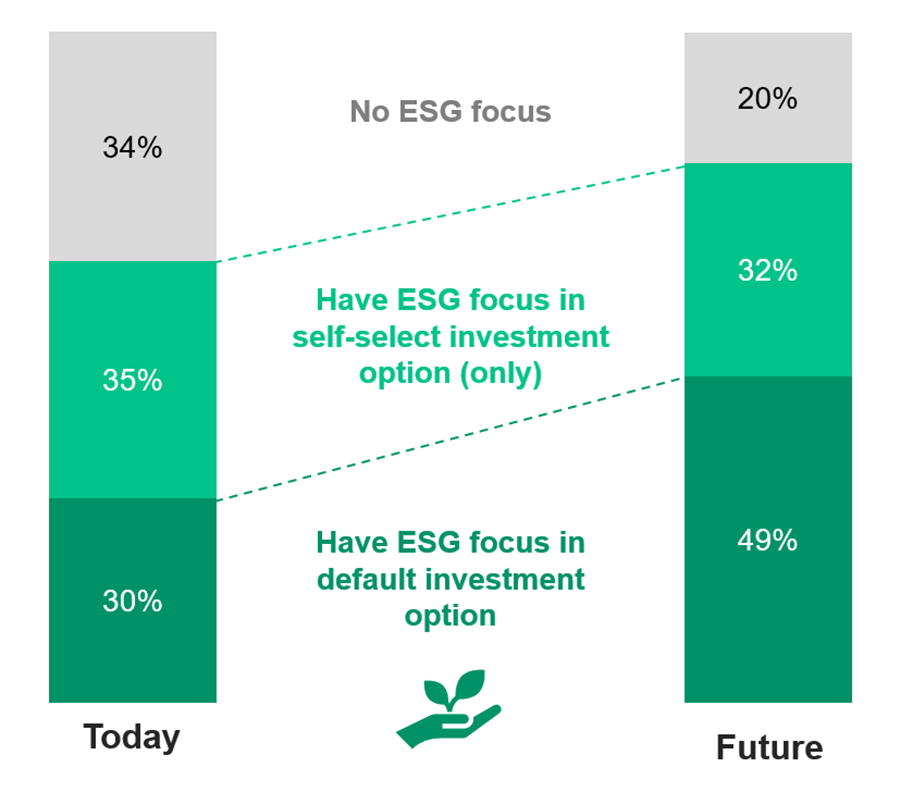

ESG continues to gain significant focus across all scheme types, with 65% already integrating ESG into their investment range. Within two years it is expected that almost half of schemes will have blended ESG into the default option, demonstrating the commitment of plan sponsors to making it easier for members to take these important investment factors into consideration.

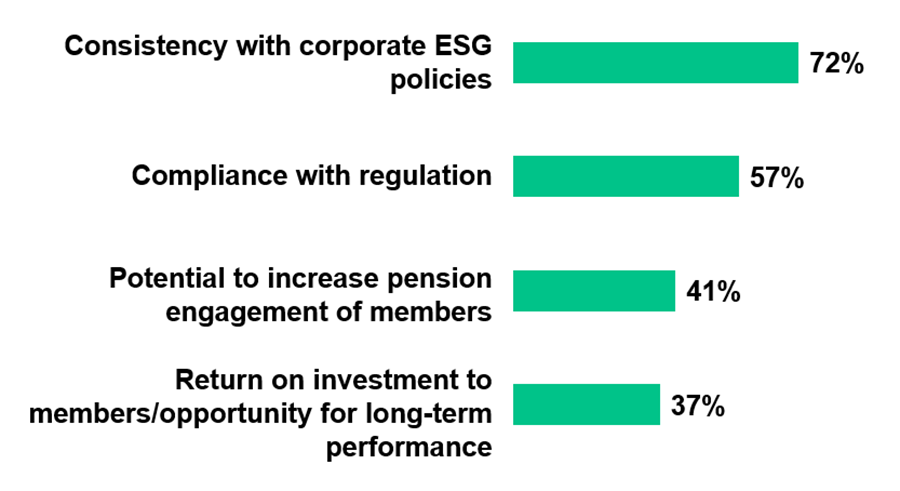

This is being driven by:

Schemes are increasingly aware that ESG can form an important aspect of engaging with members with 41% of schemes identifying engagement as one of the factors driving the focus on ESG. Campaigns such as Make My Money Matter are raising awareness of the importance of responsible investment within the pensions industry.

Note: “Future” assumes schemes “planning” to add ESG focus, will do so. Percentages may not add up to 100% due to rounding. “Don’t know” was excluded.

Source: FTSE 350 DC Pension Scheme Survey, 2021

Note: Percentages are “4/5 To a great extent”. “Don’t know” was excluded.

Sample: Companies that are at least considering ESG focus as default or self-select option.

Source: FTSE 350 DC Pension Scheme Survey, 2021

We also found that schemes of all types plan on surveying their membership to understand their views on ESG, with trust-based schemes showing greatest interest (more than two-thirds, 68%, have already undertaken a survey or are at least considering it). Where schemes have undertaken member surveys these have often provided significant opportunity for engagement. For example, results from other surveys have shown that members are often willing to contribute more into their pension when they know their savings are being invested responsibly.

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DC Pension Survey 2021 | 4.9 MB |