Taking the temperature of the pork market

With COVID-19 continuing to dominate the headlines and board agendas, it can be easy to lose focus of the wider risk landscape. However, if you are involved in pork production or any of the associated industries, the spread of African Swine Fever virus (ASF), and its potential impact on the global $400bn pork industry1 and shake-up of the wider global protein markets2 is a growing global concern.

ASF is a highly contagious viral disease that impacts swine, with a high mortality rate. The disease is ‘Notifiable’ and the veterinary services within countries are responsible for its control3. Severe cases of virus can cause death between 2 – 10 days of infection and, with no cure, can devastate entire supply chains. Disease control normally consists of culling infected herds and imposing strict quarantine procedures; there are no vaccines or treatments available.

These disruptions cascade beyond the farm boundary into the supply chain, with consequences ranging from those growing crops to feed herds, to the transport companies moving the world’s stock. However, countries not yet hit by the virus can learn valuable lessons from those already experiencing this virus and build resilience and limit the impacts.

Building resilience to risks associated with ASF requires a holistic approach, and scenarios, technology, hiring staff from the veterinary sector, and multi-stakeholder engagements are some of the tools available, all guided by scientific best practice. This is a threat no farmer can afford to ignore, and one they cannot act on alone. If ASF hasn’t visited your region, there has never been a better time to understand the disease dynamics, build awareness in your supply chain, and learn from those who are experiencing it first-hand.

As pig production is an important source of human dietary protein in many countries, particularly in areas where beef production is difficult, a threat to this source can weaken food security and limit pig production within the effected countries. These are issues that cascade beyond the exposure of individual businesses, and into discussions around country and regional resilience, which is why you will find national security agencies at the forefront of funding research into the disease4.

These knock-ons can add up, and African Swine Fever can present a considerable threat to a nation’s economy through the loss of its agricultural resources. For example, agriculture currently makes up 7.1% of Chinese Gross Domestic Product5 with the pork sector contributing 10–15% of gross agricultural value added6.

In Asia, much of the burden is falling disproportionately on smallholders, threatening increases in poverty, vulnerability, and food insecurity. ASF has driven up the prices of pork and other food supplies in this region, and it has also had substantial effects on human health, trade, climate change resilience, and local environments. As a result, international finance groups such as the Asian Development Bank (ADB) and World Bank have been keeping an eye on the issue from an international development and resilience perspective. Impacts can spread beyond individual farms and into national security as livelihoods and food security are threatened.

By modeling environmental events and physical assets, risks to property and people can be quantified and managed. This will be increasingly important as land-use changes bring more animals into contact with people through habitat disruption. The goal isn’t predictions, it’s preparedness. As we have seen with COVID-19, despite best efforts to contain infectious diseases, global supply chains always carry a risk of transmission; response requires sustained biosecurity practices, reporting, and cooperation efforts. These will be essential as the virus continues to spread. The Americas are the only region not to have been affected. But for how long?

As we have seen with COVID-19, despite best efforts to contain infectious diseases, global supply chains always carry a risk of transmission; response requires sustained biosecurity practices, reporting, and cooperation efforts.

While there is no evidence that ASF infects humans, in swine the disease is highly contagious and able to survive in the environment or processed meat for weeks and months. The virus is extremely resistant to putrefaction and sunlight, and can persist in refrigerated meat and carcasses for up to 6 months and much longer when frozen. ASF kills almost 100% of the animals it infects, with the few pigs that survive likely to become long-term carriers. The only prevention is by means of slaughter, carcass destruction and disinfection hence the need for preventative bio-security to be strictly followed7, and the threat of trade sanctions in infected regions (Note: in efforts to build awareness of symptoms you may find graphic images on sites with information in this area).

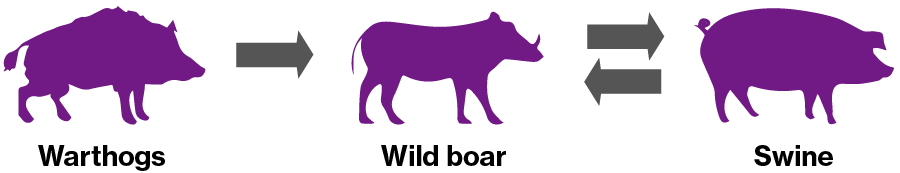

ASF is transmitted by direct contact between susceptible hosts, by ingestion of meat or meat products from infected animals, or by contact with anything contaminated by the virus such as clothing, vehicles and equipment. ASF is also transmitted to a lesser extent by bites of ticks of the genus Ornithodoros. This range of transmission points highlights the need for coordination across multiple stakeholder groups, from haulers to hunters who may cross farm boundaries.

Complied from Think Global Health8 and World Organisation for Animal Health9

Infections can result in four types of clinical manifestations:

Primary risks for companies include:

Since emerging in the early 1900s from East Africa, ASF has moved through sub-Saharan Africa and entered European countries on two occasions. Penned in and controlled at the time, developments in international trade routes and increasingly interconnected markets opened the potential for transmission, and a second wave began in 2007 when the virus emerged in Georgia11.

Since 2007, ASF continued to spread to the Russian Federation and through Eastern Europe12, including countries in the Baltic States, Poland, the Czech Republic, Hungary and Romania. In August 2018, Bulgaria and China confirmed outbreaks, shortly followed by Belgium in September. Data monitoring for governments and farmers to understand where the risk and virus are tracking is essential and is something that Willis Research Network partner Metabiota have been working on in Eastern Europe . The disease has now been reported and confirmed in several further countries such as Korea, Vietnam, Mongolia and the Philippines.

As the largest global pork market, raising an estimated 50% of the world’s pigs, the appearance in China in 2018 has led to the losses of between 25-55% of the national pig herd13. Several hundred million pigs have been lost14, with many producers choosing to slaughter their herds to prevent the disease spreading. A recent working paper by ADB highlighted that ASF’s direct costs on China and its neighbouring countries could be as much as $130 billion. However, if the disease was successfully contained in Liaoning Province, initial losses would have been $3.6 billion–$5.2 billion15.

At the beginning of 2020 Rabobank estimated that Chinese pork production would fall by 10-15%, and, while China’s supply could meet demand, the price of pork continued to rise this year. With a number of policies from the Chinese government released to encourage pork production and reach a self-sufficiency target of 95%, there are some estimates that the market could recover within the next 12 months. Figures from The Chinese National Bureau of Statistics stated that a higher volume of pork was produced than expected, hinting at signs of recovery. Industry research suggested that 24 million pigs would be slaughtered in October – an 8% rise on September 2020 – in comparison to the typically monthly figure of 45 million16.

However, there has been a decline in protein across Asia, and the longer it goes on the more potential that consumer demand could shift to other products. This also creates opportunities in the short term for pork producers in the Americas and ASF free zones while demand from China is high and pork prices are high.

The chaos of renewed global lockdowns raises the question of what the current landscape may look like, and how markets can think about establishing biosecurity measures. For example, in Germany, tracking down infected wild boar has involved the use of sniffer dogs, helicopters using thermal imaging cameras, and drones, as well as a €6 million investment by authorities in Brandenburg in the construction of a permanent stable fence17.

The scale of response needed is more than any one company or country can shoulder the burden of and requires stakeholders throughout the value chain working together, which is why many countries are exploring scenario-based exercises in partnership with industry. The World Organisation for Animal Health maintains a list of these simulations, with many allowing international observers to share knowledge and build capacity - a number of exercises scheduled for 2020 have been postponed, however 12 were run across the world in 2019 and companies can use these to stress test their risk management strategies18.

Looking at the outbreaks over the last 18 months against the global distribution of pigs, the currently untouched Americas is a scenario waiting to happen. The United States is home to nearly 12% of the world's 677.6 million pigs19. At a national level the U.S. pork industry supports more than half a million jobs in the United States, the majority of those in rural areas20.

Please click here to view the African Swine Fever outbreaks map21

With annual US market estimates of $20 billion22 it is understandable that United States Department of Agriculture (USDA) is concerned about the potential impacts ASF could have on swine producers, local communities and the wider economy23. Strict animal health and import requirements are enforced by USDA Animal and Plant Health Inspection Service (APHIS) Veterinary Services, USDA APHIS Plant Protection and Quarantine and Customs and Border Protection to prevent entry into the country.

In recognition of this potential risk and the need for coordination across trading borders the chief veterinary officers of the United States, Canada, and Mexico established the foundations of a North American strategy in August 2019. Their plan call for action in key areas such as comprehensive disease surveillance, surge capacity in labs, contingency planning and border security including inspection and control measures24.

Efforts are also ongoing to understand the risk and inform surveillance strategies and policy action, and three different studies showcase research, simulation exercises, and scenarios that are being undertaken to explore uncertainty:

The responsive scenario outlined in the research paper assumes that the United States gets the disease under control and re-enters export markets within two years. The study also describes a lingering scenario where the disease spreads to feral swine and the United States is unable to eliminate the disease over the ten-year projection period – the difference in action is $35bn:

| Impacts/Scenario | Two year scenario | Ten year scenario |

|---|---|---|

| Revenue losses: lower prices and quantities sold would lead to a decline in pork industry revenues | $15bn total over two years Assumes the US quickly gets the disease under control and re-enters export markets within two years |

$50bn total over 10 years Assumes the disease spreads to feral swine and the US is unable to eliminate the disease over the 10-year projection period; and exports never resume |

| Employment: getting the virus under control within the two years is essential for job security | Minimal job losses at the end of 10 years | 140,000 job losses at the end of 10 years |

These scenarios are a few examples of the resources available to companies, and are powerful ways to communicate potential risks and opportunities to human decision-makers. Storylines in particular have been advocated as a better way to provide actionable information, because storylines seek to improve risk awareness, as scenarios better correspond to how people perceive and respond to risk.

There is real value in exploring these scenarios – and others – and asking yourself how you would respond. Risk doesn't wait in an orderly queue; you may have to deal with adverse weather conditions and failure of machinery at the same time. Right now, COVID-19 brings a host of unique challenges around social distancing – have these additional biosecurity factors introduced more effective protocols?

If an outbreak occurs, financial risks could go beyond the tangible values of losing your stocks, being unable to fulfil contracts, losing suppliers as they source alternatives and increased costs of sourcing resources such as disinfectant and vet time, and broaden into the intangible side of reputation and brand loss. Thinking through how you would respond will help strengthen resilience, no matter what the source of disruption. This is something Willis Towers Watson has been helping our clients with through our global network of Willis Research Network partners.

Thinking through how you would respond will help strengthen resilience, no matter what the source of disruption. This is something Willis Towers Watson has been helping our clients with through our global network of Willis Research Network partners.

Robust risk management practices should include a thorough understanding of the risk landscape, to ensure appropriate identification and analysis of risk. This will enable decisions to be made around the control, reporting and monitoring of those risks. Companies can use this information to demonstrate to underwriters that biosecurity measures and protocols are in place. Being able to show action is being taken – lowering the risk – can then be factored into underwriting decisions.

While London markets are still providing cover for ASF in certain territories, appetite for risk in Europe is dwindling as cases move west. Continued coverage from insurers is aided in some cases by governments taking a stance on disease protocol and compensation schemes, to give comfort that on a national level protocols are being put in place and adhered to. We have also seen several producers hire veterinarians into biosecurity roles to harness expertise, and we can provide insight into industry best practice. These kinds of partnerships are essential to building trust along the chain and ensuring that Willis Towers Watson clients have the cover and advisory they need, whether this is business interruption insurance or input into innovative solutions.

Being able to evidence the ability to identify and isolate an outbreak within your business, to contain outbreak to one unit/location and prevent cross contamination will be essential, and various technologies are being explored to do this. For example, combining telemedicine for rapid response, alongside on-farm and in-transport sensors could monitor pig welfare, and harness machine learning to identify patterns at an early stage that would prevent stalling of supply chains. This would be beneficial to producers and regulators, and could tap into the growing consumer interest around welfare, sustainability and provenance.

Elements of this approach are currently being trialled by Bristol Robotics Laboratory, who are in the middle of a multi-year project to use advances in machine vision and machine learning to automatically detect and monitor key affective states in individually identified pigs, and measure performance traits using only the face29. To date they can reliably group images of stressed and non-stressed pigs, and the team are exploring the development of a system that would offer the capacity for on-going learning about individual pigs, allowing for early detection of altered health/welfare, personalised thresholds for intervention, and tailored treatment approaches.

As we’ve seen across Asia, the effects of ASF on the larger economy, livelihoods, food security, human health security, and the environment are substantial, and given the progression of the virus it feels like a case of not if but when it will reach the Americas.

Interconnected problems require integrated solutions, and this is where scenario-based thinking and expert partnerships can be used to explore the impacts from those already experiencing the virus, and leverage those resilience lessons to explore complex risks and decide what to do next. This will be essential to provide comfort to carriers that the risks are understood, and that action is being taken before capacity is questioned.

The important lesson from COVID-19 is that not all pandemics will look this like one, which highlights the importance of building understanding about the risk landscape, and ensuring that any investments made in combatting ASF will have holistic benefits against future animal diseases and consumer trends. If you are looking at new technology investments or hiring choices, considering ASF within those could uncover new challenges before you face them.

1 https://www.thinkglobalhealth.org/article/pig-pandemics-and-other-epizootic-threats

2 https://www.rabobank.co.nz/media-releases/2020/200623-nz-red-meat-sector-to-benefit-as-asf-continues-to-weigh-on-global-animal-protein-markets/

3 https://www.pirbright.ac.uk/files/quick_media/ASFV%20Fact%20Sheet%20DL%20Leaflet

_FINAL.pdf

4 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5662547/

5 https://www.statista.com/statistics/270325/distribution-of-gross-domestic-product-gdp-across-economic-sectors-in-china/#:~:text=In%202019%2C%20the%20agricultural

%20sector,from%20the%20service%20sector%2C%20respectively.

6 https://www.nature.com/articles/s43016-020-0057-2 - :~:text=Agriculture%20currently%20

makes%20up%207,Chinese%20GDP%20by%20approximately%201%25.

7 https://www.aphis.usda.gov/animal_health/emergency_management/downloads/

asf_strategies.pdf

8 https://www.thinkglobalhealth.org/article/pig-pandemics-and-other-epizootic-threats

9 https://trello.com/b/GloiZoik/african-swine-fever-oie

10 http://www.cfsph.iastate.edu/Factsheets/pdfs/african_swine_fever.pdf

11 https://www.thinkglobalhealth.org/article/pig-pandemics-and-other-epizootic-threats

12 https://www.metabiota.com/publications/page/2#!complete-genome-sequence-of-a-virulent-african-346

13 https://www.adb.org/sites/default/files/publication/645541/eawp-27-losses-african-swine-fever-prc-neighboring-countries.pdf

14 https://www.rabobank.co.nz/media-releases/2020/200623-nz-red-meat-sector-to-benefit-as-asf-continues-to-weigh-on-global-animal-protein-markets/

15 https://www.adb.org/sites/default/files/publication/645541/eawp-27-losses-african-swine-fever-prc-neighboring-countries.pdf

16 http://www.pig-world.co.uk/news/china-pork-production-shows-signs-of-recovery.html

17 https://www.pigprogress.net/Health/Articles/2020/9/ASF-Germany-Fight-is-intensified-as-number-of-infected-boar-increases-to-20-644914E/

18 https://www.oie.int/en/animal-health-in-the-world/the-world-animal-health-information-system/simulation-exercises/2019/

19 https://ourworldindata.org/grapher/pig-livestock-count-heads

20 https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/swine-disease-information/african-swine-fever/joint-statement

21 https://www.arcgis.com/apps/MapJournal/index.html?appid=db62d00222644945862b40fe6277831a#

22 https://www.dhs.gov/science-and-technology/news/2019/11/12/snapshot-what-do-african-swine-fever-epidemic-us

23 https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/swine-disease-information/african-swine-fever/seminar

24 https://www.aphis.usda.gov/aphis/newsroom/stakeholder-info/sa_by_date/2019/sa-08/afs-joint-statement

25 https://www.nature.com/articles/s41598-019-50403-w

26 https://www.dhs.gov/science-and-technology/news/2019/11/12/snapshot-what-do-african-swine-fever-epidemic-us

27 https://www.agriculture.com/news/livestock/14-states-ask-what-if-african-swine-fever-hits-the-us

28 https://eu.desmoinesregister.com/story/money/agriculture/2019/09/27/iowa-pigs-african-swine-fever-outbreak/2438868001/

29 https://gtr.ukri.org/projects?ref=BB%2FS002138%2F1#/tabOverview