We have found that acceptable returns from traditional investments are increasingly hard to find. Equities may promise strong returns, but based on our experience, the price is high risk and elevated volatility. Bonds have delivered for many years, but that era may be over. Alternative credit has the potential to deliver equity-like returns at much lower risk levels.

Credit is vital for business to survive and for economies to thrive, yet since the global financial crisis regulators have made it harder for traditional lenders, like banks, to supply credit. Borers still need to bor though, and institutional investors can bridge the gap and make good returns doing so. This is one of the biggest developments in credit markets since the financial crisis and the asset class has gn too big to ignore, yet many investors in Asia don’t hold it yet. Most asset owners should at least form a view on this opportunity.

Alternative credit still has a strong tailwind from the global financial crisis, as banks remain under pressure to rebuild capital and reduce their risks. We believe that this leaves a sizeable ongoing opportunity for institutional investors to step into the breach and potentially become profitable lenders.

Alternative credit as an asset class encompasses a wide range of lending opportunities. Taking a nar approach is too risky. Applying a broad approach can result in a more robust portfolio.

Why should asset owners go beyond the mainstream credit sources and consider alternative credit? We will explain the following key reasons:

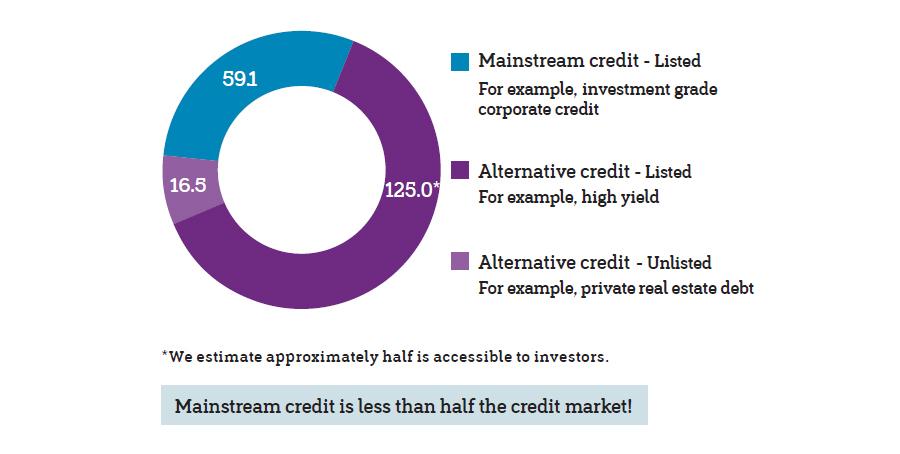

We estimate there is now more than twice as much alternative credit as mainstream credit (see Figure 1). The asset class is ging and broadening at a rapid pace since the global financial crisis, providing more potential opportunities and giving rise to diverse strategies.

Source: Willis Towers Watson, data as of 31 December 2016

Many credit investors focus solely on high-yield bonds and bank loan markets as alternative credit sources. However, we have found that listed high-yield corporate credit tends to be a poor stand-alone solution for alternative credit exposure because it is an index-led cded market and brings little diversity. Also, this is limiting and ignores other investable credit opportunities, which can offer attractive risk-adjusted returns and may have a substantially positive impact on your portfolio.

We find these opportunities reside in alternative credit markets, which used to be dominated by banks and were largely inaccessible to investors. As the banks retreated, they left a gap for institutional investors to step in and potentially generate returns. This part of the market is attractive because it is more illiquid, more inefficient, and more under-researched by the mainstream investment community.

By investing in alternative credit, we believe you are lending to the real economy. As with all lending, you receive the promise of income from interest, coupons and fees, which should more than compensate you for the risks that your capital is not fully repaid when it is due. We observe a well-diversified alternative credit portfolio can offer attractive yields to many investors today.

"A well-diversified alternative credit portfolio can offer attractive yields to many investors today.”

Alternative credit is different from mainstream credit, such as investment-grade bonds. Potentially it has a much higher expected return, more like the returns you hope for on your equity investments. This is thanks to its higher income. And yet, its volatility and risk potential may be much lower than that of equity — equity holders start to lose value from their investment in a company long before the company is in danger of defaulting on its debt.

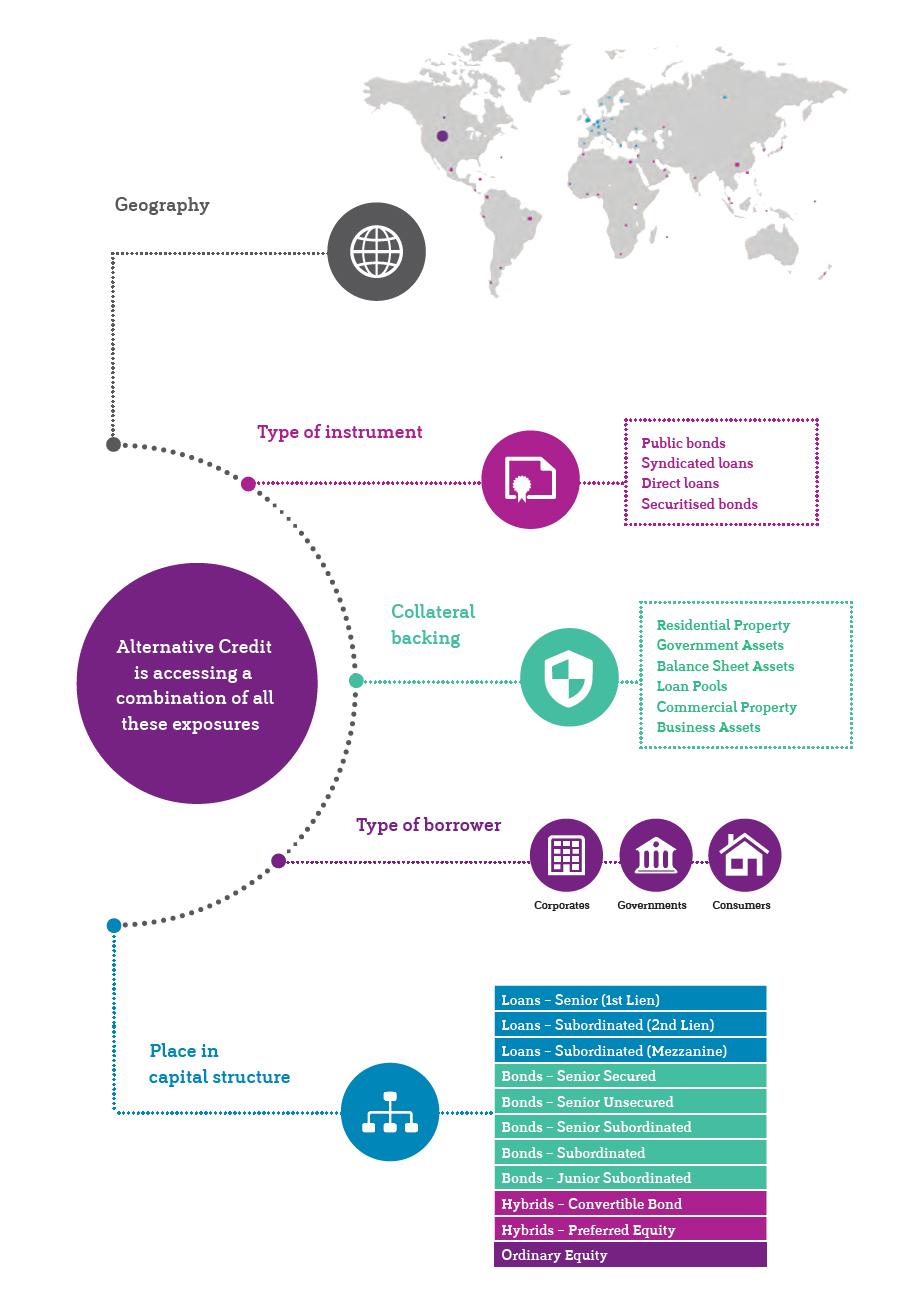

One of the strengths of alternative credit is its diversity. We advocate a broad strategic allocation across the full range of risks shown in Figure 2.

Source: Willis Towers Watson

In alternative credit you want to lend to borers around the world, not just in the US, to different types of borers, your lending should be backed by different types of assets and you should operate in different parts of the capital structure. To do all that, you need to avoid the generalists and employ specialist investment managers who know their niche very well.

The factors that drive returns from alternative credit are different from those of traditional asset classes, so the correlation with a portfolio’s traditional investments is low. Alternative credit aims to tap into such themes as rising wealth in emerging economies and the shortage of bank lending in many regions of the world.

Based on our experience, fixed-income return drivers, such as term and inflation risk, have relatively little influence on returns from alternative credit. Equally, while equity risk is largely driven by big companies, alternative credit tends to involve lending to smaller companies (many of them unlisted), consumers, real estate owners, and governments of varying sizes and stability, as well as loans secured on almost any asset as shown in Figure 2.

With low liquidity, high trading costs and access often through closed-end vehicles, alternative credit is not an asset class suited to frequent tactical asset allocation changes. Its management needs to be strategic and carefully implemented.

Indeed, another potential key benefit of alternative credit is the illiquidity premium. Illiquid opportunities, such as private debt funds, may return more than their public, or liquid, counterparts. Lenders often have less competition, can impose higher interest rates, and demand fees for arranging or changing the terms of a loan. Managers implementing hedged strategies and arbitrages in illiquid funds can take on more market pricing risk, secure in the knowledge that they will not have to reverse positions before they mature. A well-diversified portfolio can provide quarterly liquidity, which is reasonable for most long-term investors.

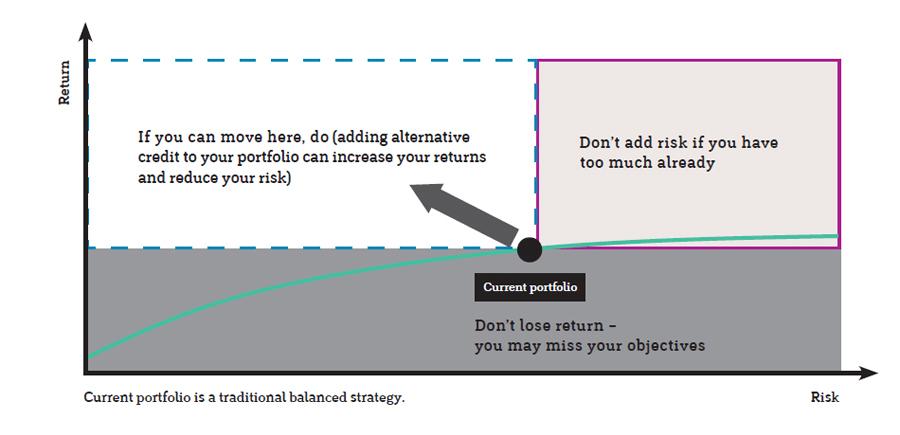

We believe adding alternative credit makes most investors’ portfolios more efficient. Switching from equities sustains expected returns but may reduce risk, while switching from bonds generally adds little risk but may considerably boost returns. These potential benefits are illustrated in Figure 3, below.

For investors building assets to buy out liabilities or moving gradually into risk-free assets, the potential benefits of alternative credit can include substantial reductions in sponsor contributions or a significantly shorter journey to full funding. We believe it can also help avoid drawdowns, which can lengthen this journey considerably.

Source: Willis Towers Watson

Alternative credit can be a way for investors to improve portfolio risk or returns. In our opinion, getting the best out of alternative credit is about gaining access to multiple specialists and managing the portfolio dynamically. This is easily said, but harder to achieve. We believe it requires investors to set out clearly their investment beliefs and then implement them efficiently and skillfully.

Asset owners should consider a broad opportunity set to exploit diversification and access markets where active management can be better rewarded. We have found that portfolios are more resilient when they are diversified across a range of specialist managers.

"Asset owners should consider a broad opportunity set to exploit diversification and access markets where active management can be better rewarded.”

Successful investing requires a competitive edge — in research, portfolio management, execution, cost control, culture and governance. We believe managers that take a long-term view have a competitive edge. We believe managers that are able to take short, as well as long, positions have a competitive edge too.

At Willis Towers Watson, we engage with managers to potentially improve outcomes and consider costs as an important factor. We strive to identify the best strategies and bring them together in a single proposition.

For further information on our alternative credit solution, contact your usual Willis Towers Watson consultant or:

investment.solutions.asia@willistowerswatson.com

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.

This article is included in this year’s stand-alone reprint of AsianInvestor’s 300 or AI300 titled “Alternative Credit Investing – Broadening Sources of Equity-like Returns”. The reprint of AI300 also includes an annual ranking of the biggest asset owners in the Asia Pacific region by assets under management, carried out independently by the editors of AsianInvestor using publicly available data. Since 2004 Willis Towers Watson has sponsored the study. Click Download to get a soft copy of the reprint.

| Title | File Type | File Size |

|---|---|---|

| Uncovering alternative credit opportunities | 2.3 MB |