Engaging in investment strategy decisions during funding discussions can improve outcomes

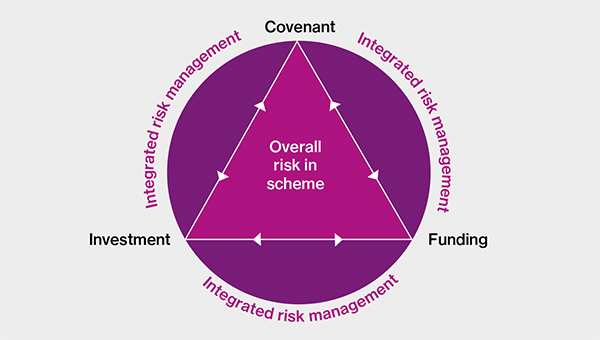

TPR's guidance on IRM highlights the importance of integrating investment decisions within actuarial valuations. Ed Wilson and Zoë McCrossan take a closer look at how engaging early in investment strategy can help improve funding outcomes.

TPR’s guidance on IRM highlights the importance of integrating investment decisions within actuarial valuations. Changes to investment strategy can have a material impact on the funding level as well as the resulting contribution requirements for the company. Therefore, engaging early in investment strategy as part of the valuation discussions can help companies achieve better outcomes.

In their code of practice on scheme funding, tPR states the following:

“The investment strategy will also likely impact on the assumptions used for setting technical provisions prudently (for example, the discount rate used when valuing assets and liabilities) and for setting an appropriate recovery plan).”

Therefore, to get the most out of an investment strategy review, we recommend that it is carried out at the same time as the actuarial valuation, rather than waiting until after the results are finalised. Often, not all stakeholders are engaged in the valuation until the preliminary results are available. However, it is a requirement for the trustees to consult with the employer on investment decisions, and we are seeing that those employers who are actively looking to engage in investment discussions early in the valuation process, are obtaining better outcomes as well as benefiting from the joined-up thinking, where all parties are pulling together towards a common goal.

The technical provisions and recovery plan are generally built around the scheme assets achieving a required investment return. If the trustees have a desire to de-risk, then it is crucial to have your investment strategy discussions linked to your funding strategy. Otherwise, if the investment strategy is de-risked, with a lower return expected in the future, then this may lead to increased contribution requirements. This would be a nasty surprise to stakeholders, which can be avoided by properly integrating investment strategy with funding plans.

Investment strategy is always a trade-off between risk (relative to your liabilities) and return potential. Depending on your scheme’s particular circumstances, it is possible to build into the valuation results a prudent estimate from an investment strategy that creates a ‘win-win’ situation, in terms of lower risk but with a better risk-adjusted return expectation.

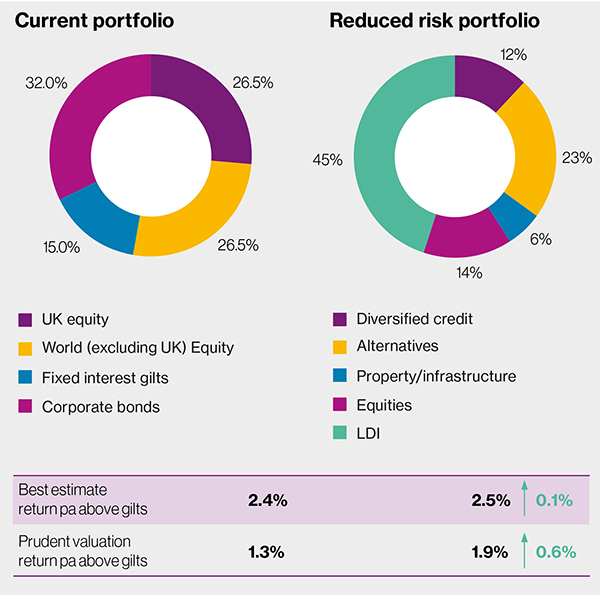

Diversification is the cornerstone to building an efficient asset portfolio. However, the central return expectation can mask the possible return distribution including long tails (that is, significant probabilities of making a lot or losing a lot). A portfolio where the possible returns have a tighter distribution in and around the expected return is preferable, particularly when it comes to applying prudence as part of the technical provisions calculations.

Figure 2 below demonstrates the benefits of a more diversified portfolio in terms of obtaining additional return for a similar level of risk.

Another area that can be particularly useful in managing investment risk relative to liabilities are liability-driven investments (LDIs). LDIs can offer the same, or greater levels of protection against risks such as interest rate and inflation without having to hold as much in physical matching assets. This can substantially free up assets to be used in more return-seeking assets. Bringing this together with diversification can have a material impact on the valuation assumptions.

Figure 2 illustrates two investment strategies. These have similar best estimate returns, but after adjustment for prudence, as tPR requires, the prudent valuation assumption is actually higher. In the first portfolio, the best estimate return is gilts plus 2.4% per annum, and the margin required for prudence is 1.1% per annum giving a valuation assumption of gilts plus 1.3% per annum. This compares with the second portfolio, which is more diversified with some liability hedging, where the best estimate return is very similar at gilts plus 2.5% per annum. However, the margin required for the same level of prudence is only 0.6% per annum, resulting in a valuation assumption of gilts plus 1.9% per annum. The advantage here is that you can de-risk your portfolio but actually increase the discount rate that is built into the actuarial valuation. This can have a significant impact on the contribution requirements for the scheme.

Recent strong market returns may mean that it is worth bringing forward those discussions even ahead of the valuation if it’s not due in the near future. Equities have performed strongly over the last year or so, particularly on an unhedged basis, but our investment outlook suggests the prospect of longer-term lower returns. Furthermore, real yields have risen slightly based on recent hawkish comments from the Bank of England about interest rates.

Many schemes have de-risking triggers in place to capture these market movements. However, with such fixed targets, there is always the danger of getting very close to the trigger, but just missing it. There could be significant regret risk if this happens and there is a market fall before any investment strategy changes are implemented. This is coupled with the possibility that other factors such as mortality improvements and transfer-out activity may mean some schemes are closer to a trigger level than they realise, as these experience factors do not show themselves until a formal valuation is carried out. Pre-empting these discussions could prove beneficial in helping to ensure that a collaborative approach is taken to best provide the right solution for all parties.

The way P&L is presented under US GAAP is changing for financial years beginning after 15 December 2017 (although early adoption is possible). One of the key changes is that the service cost will be the only pension element included under ‘operating profits’ in the P&L.

Depending on a sponsor’s key financial metrics, this could have two potentially important implications for pension schemes with sponsors who report on US GAAP:

Both items will still come through lower down in the P&L statement, in non-operating profits. Therefore, in conjunction with the comments regarding current returns, de-risking in the current environment may now be more attractive to sponsors in the US.

If your scheme is approaching a valuation, we recommend tabling investment strategy as a key part of the discussion early in the process, as working collaboratively will help maximise the opportunity to find a long-term solution which suits all parties. For further help with integrating your investment strategy into your funding discussions, please contact your usual Willis Towers Watson consultant.